Subscription

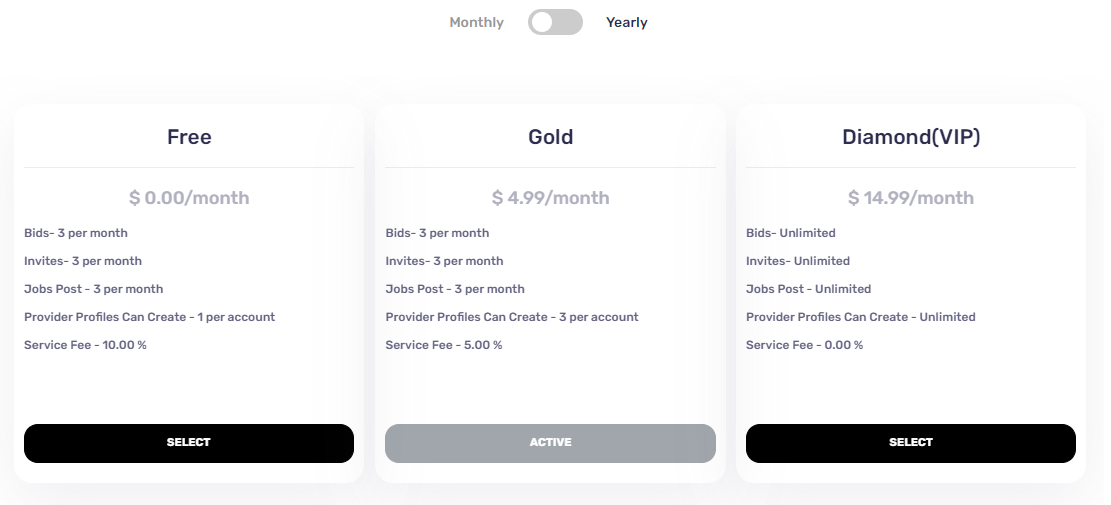

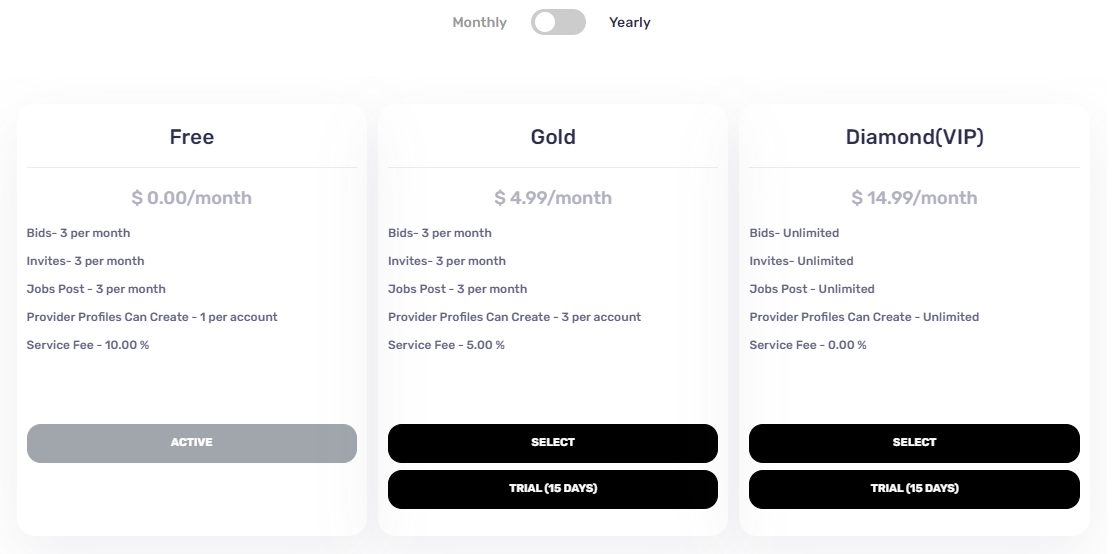

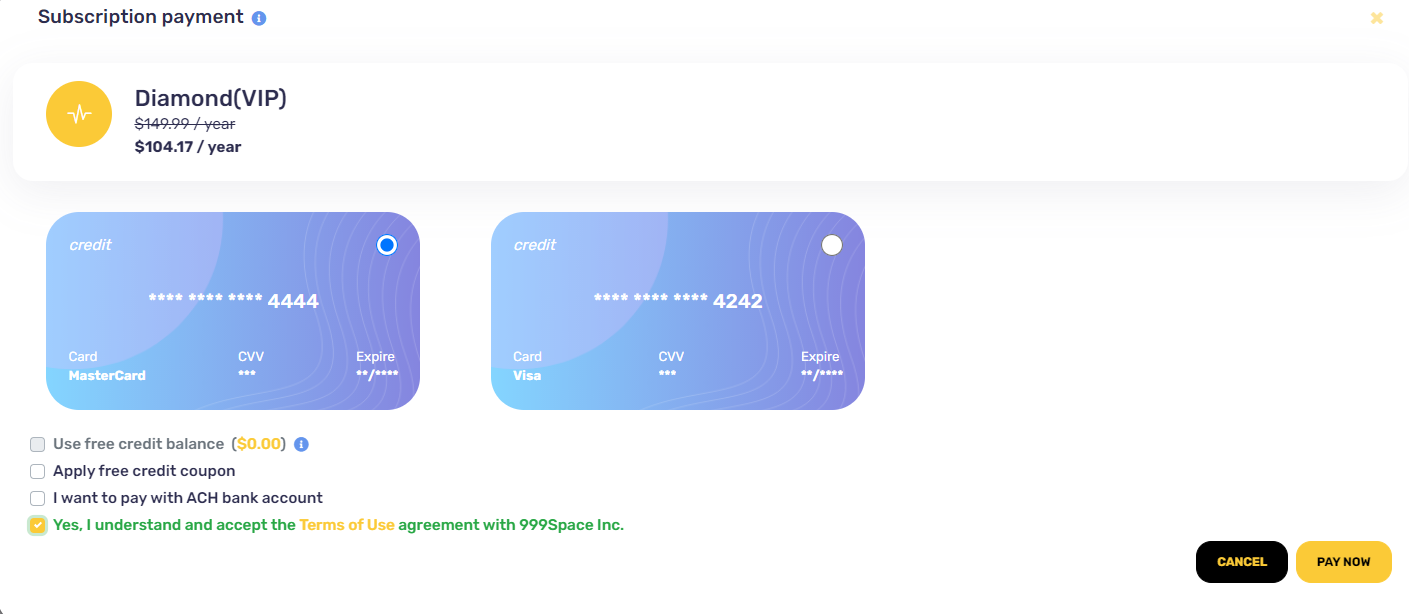

Subscription charge is charge from user to buy some features in application. In this application we are providing total 3 plans (Free, Gold, Diamond(VIP)) respectively. These 3 plans are available on monthly or yearly basis. Each Plan having features which is used for as client or service provider are given below.

Subscription list

- 1. Free

- 2. Gold

- 3. Diamond(VIP)

Types of services in subscription

- 1. Bids

- 2. Invites

- 3. Provider Profile Can Create

- 4. Jobs Post Per month

- 5. Service fee

A. Bids

This feature is used by user as service provider. When Service provider apply or bid on job. These count represent how many times provider can do bid on job.

B. InvitesThis feature is used by user as Client. When client send a invite to service provider to apply or bid on their job. These count represent how many times client can send invite to service providers.

C. Provider Profile Can CreateThis feature is used by user as Provider. We are giving the option to create service provider multiple profiles, so he can create multiple profiles according to their talent or interest .This count represent how many Provider can create more profiles.

D. Jobs Post Per monthThis feature is used by user as Client. When client want to hire someone or looking for someone who will do his work, first he needs to create a job. These count represent how many times client can create job per month whether plan is monthly or yearly basis.

E. Service feeThis feature is used by user as client. When client pay to service provider , this percentage of charge is applied when client pay contract money. For example, client pay $10 to provider if client active current plan which has service fee 10% then client have to pay $1.00 as service for $10.00 contract.

Trial subscription:15 days trial for all paid plan once.

Discount on subscription:

If user is on any yearly paid plan, if he upgrade his plan to anoyther yearly plan, then he can get that plan with less amount of current plan charge .

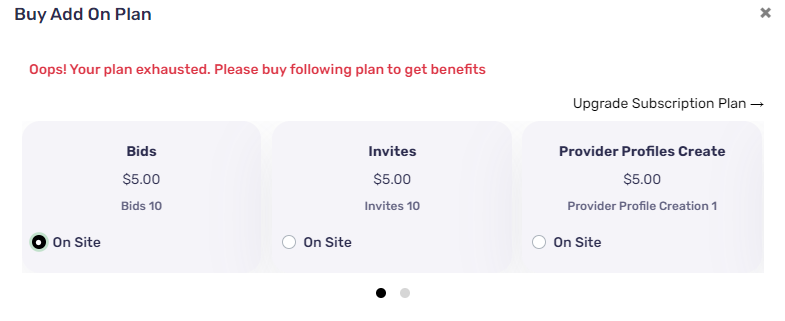

Add on plan

Add-on plan is used to boost or increase capacity of current paid plan(gold, diamond) rather than buying new plan. In this application we are providing the following boosters with existing plan.

Add on plans list

- 1. Bids

- 2. Invites

- 3. Provider Profiles Create

- 4. Jobs Post

These plans increase the relative plan’s capacity.

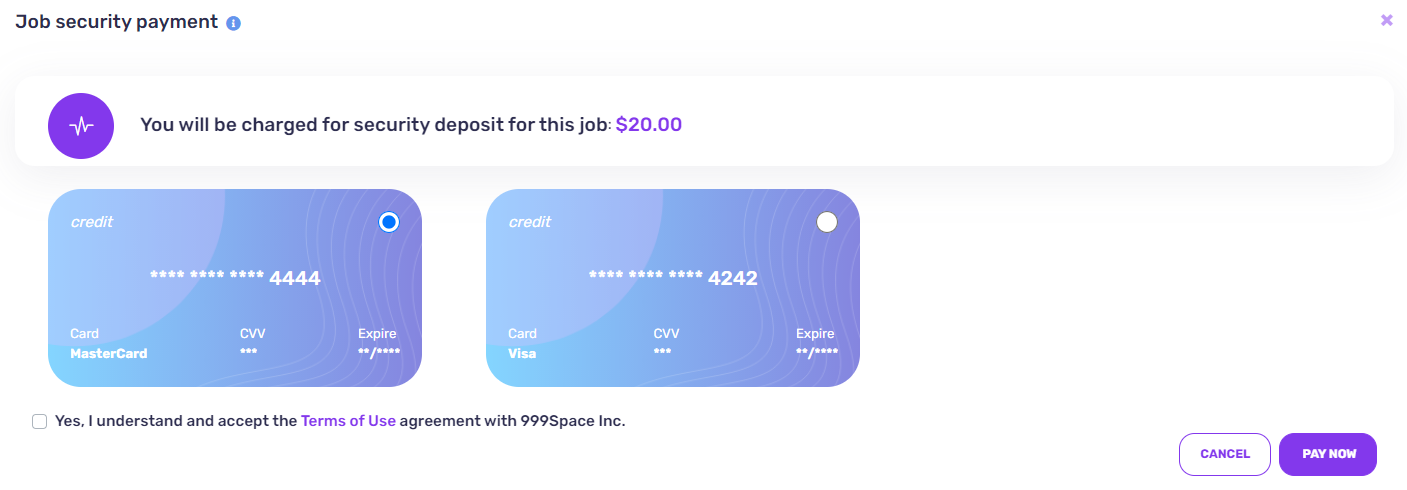

Job security charge

The job security is a amount that is hold on the client's payment method. This will be automatic unlocked after 7 days. That means no amount is debited or credited from account. The hold amount is depends on the job category and sub-category. There are four differnt levels of job security charge level...

-

Job security levels

- Job security charge level 1

- Job security charge level 2

- Job security charge level 3

- Job security charge level 4

-

1. Job security charge level 1:

For eg. suppose job amount is $10.00 and job security level is 1 for your job as per category and subcategory. If level-1 charge percentage is 10% then your job security amount is (x%) of level-1 of total job amount (10% of $10.00) i.e $1.00.

-

2. Job security charge level 2:

For eg. suppose job amount is $10 and job security level is 2 for your job as per category and subcategory. If level 2 charge percentage is 20% then your job security amount is (x%) of level-2 of total job amount (20% of $10.00) i.e $2.00.

-

3. Job security charge level 3:

For eg. suppose job amount is $10 and job security level is 3 for your job as per category and subcategory. If level-3 charge percentage is 30% then your job security amount is (x%) of level-3 of total job amount (30% of $10.00) i.e $3.00.

-

4. Job security charge level 4:

For eg. suppose job amount is $10 and job security level is 4 for your job as per category and subcategory. If level-4 charge percentage is 0% then your job security amount is (x%) of level-4 of total job amount (0% of $10) i.e $0.00 Then user is not redirecting to pay job security screen.

- Note: Minimum hold amount is depends on the currency of your job. For USD: $1.00, CNY: ¥50.00. If job security charge percentage is zero for yor job then after clicking on post job user is not redirecting to pay job security screen.

This job security charge process is added for serious clients, who actually want to hire someone with help of posting a job.

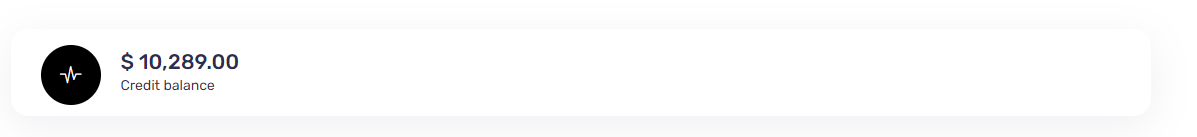

Credit balance

Credit balance is total balance of all upcoming payments from resources like contracts, rewards etc.It appear in Payment tab in account section

Service charge

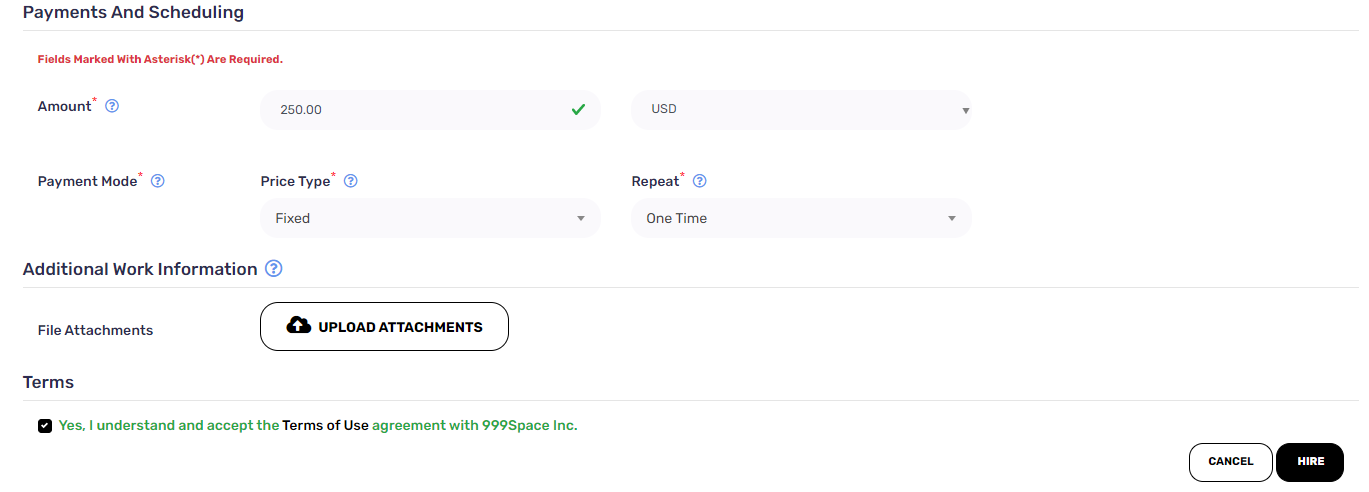

Service charge is a payment that is given by client to service provider after successfully given completion of work. Following are types of payment methods/ways uses during contract:

-

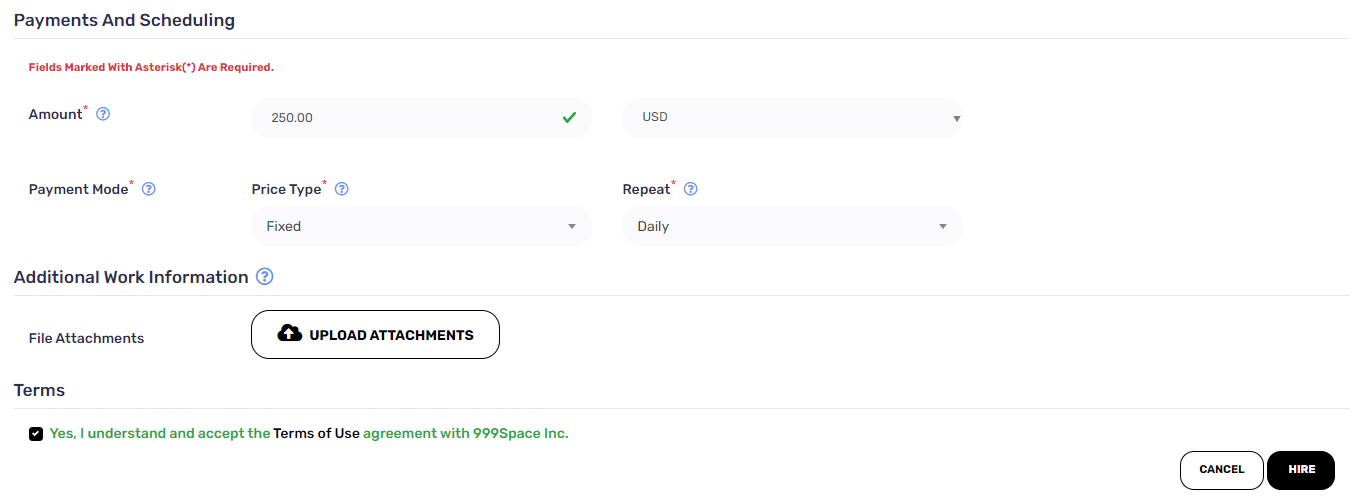

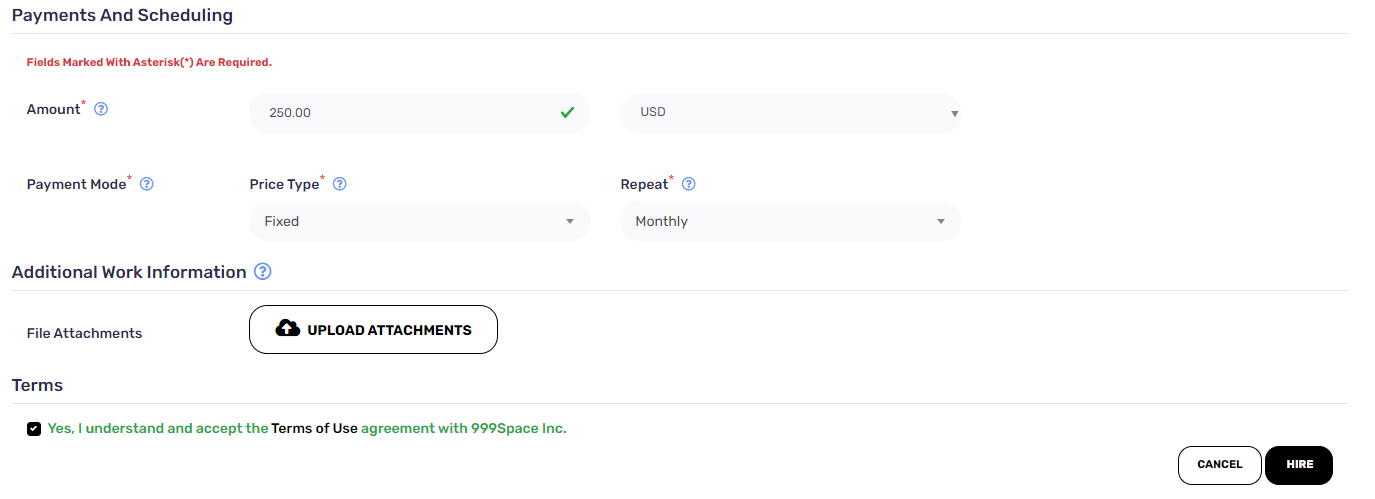

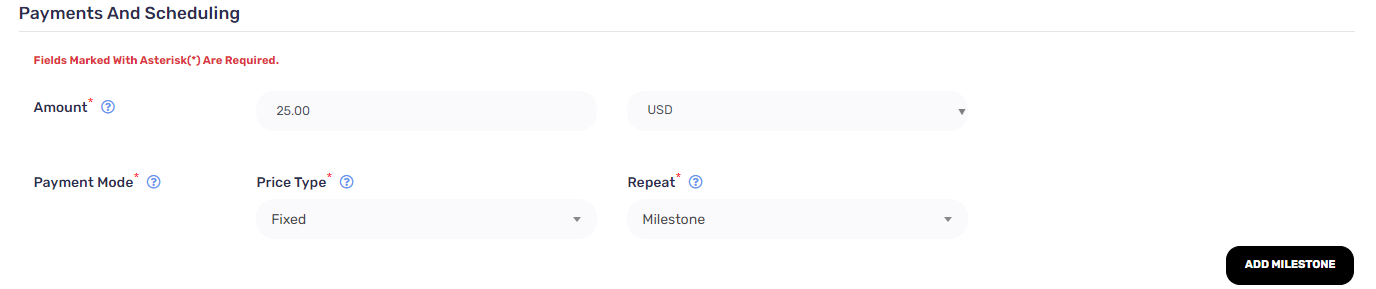

A. Price Type

- 1. Fixed

- 2. Hourly

-

B. Repeat

- 1. Fixed

- 2. Daily

- 3. Weekly

- 4. Biweekly

- 5. Monthly

- 6. Yearly

- 7. Milestone

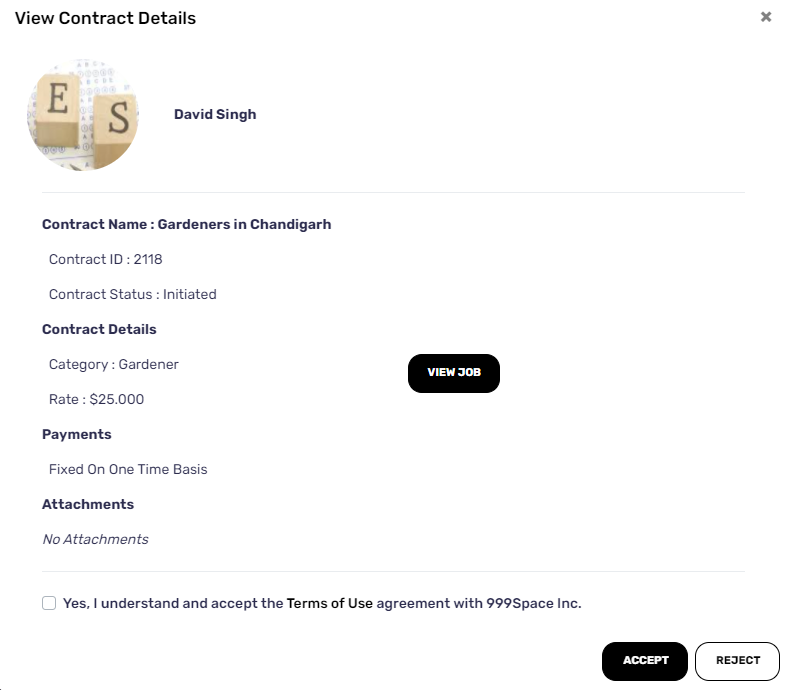

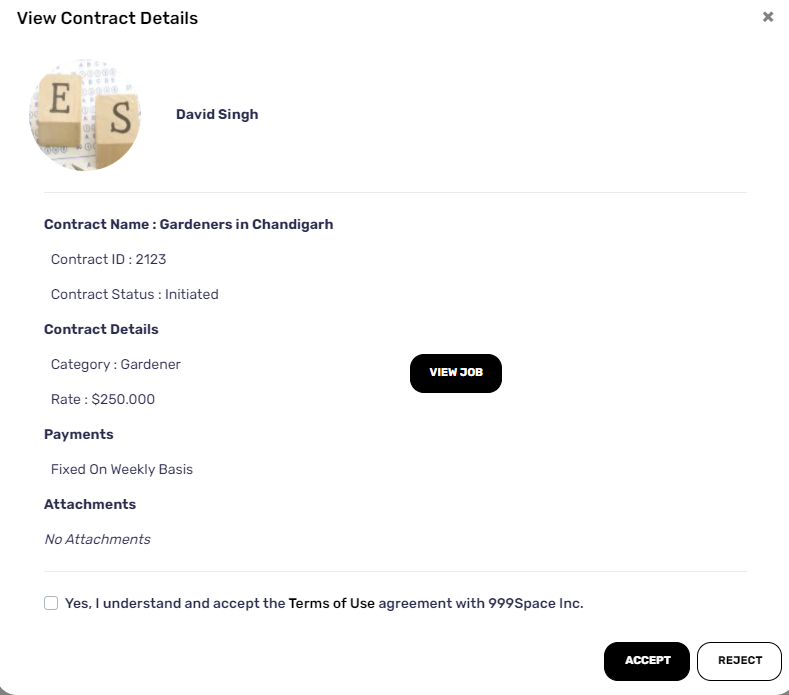

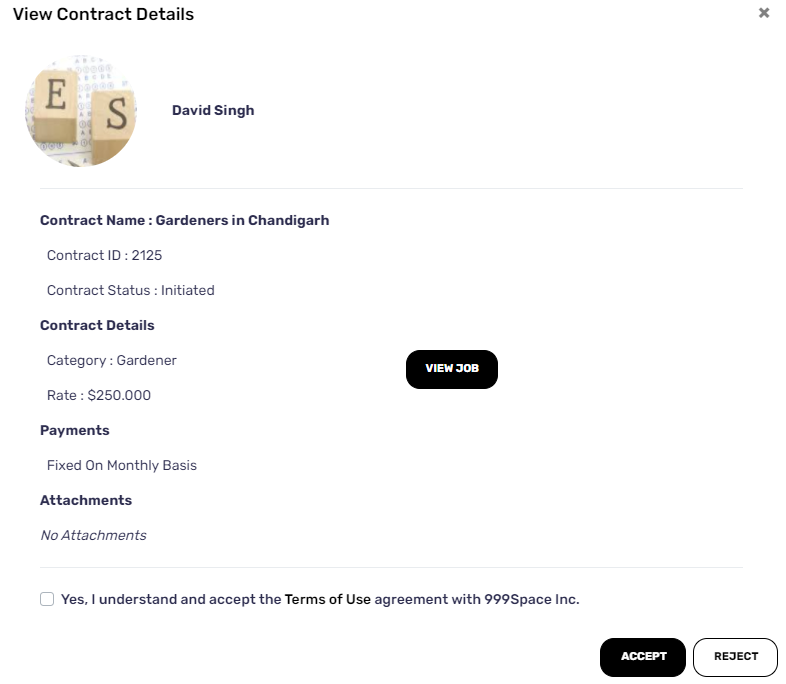

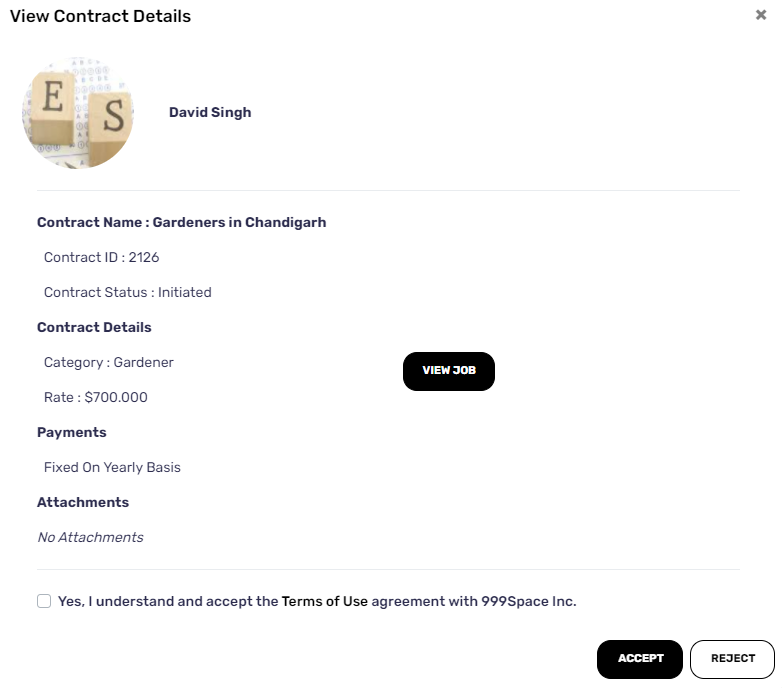

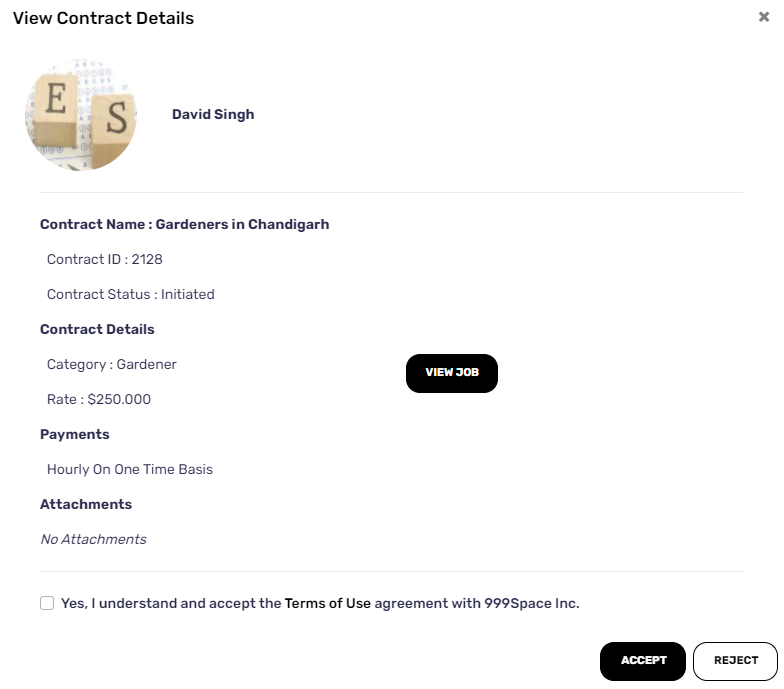

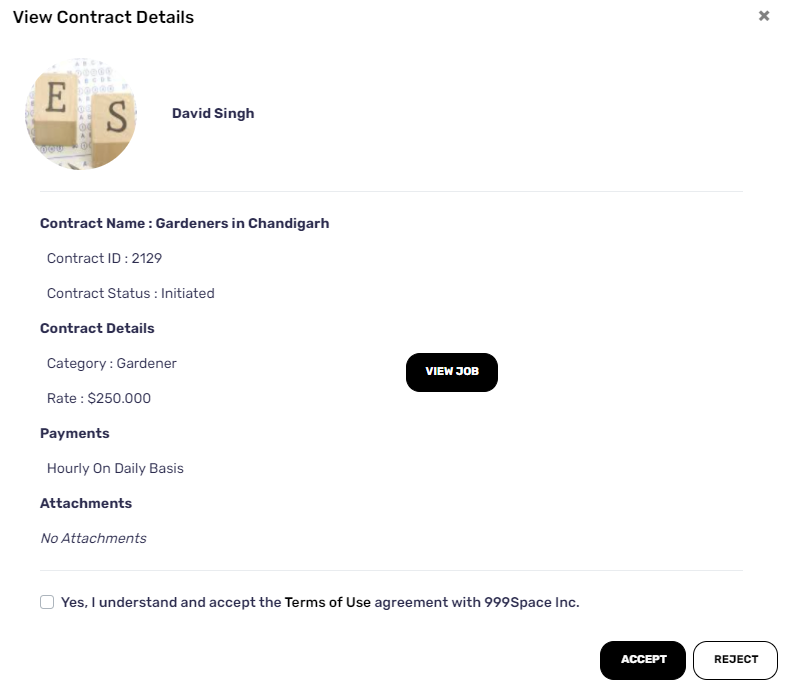

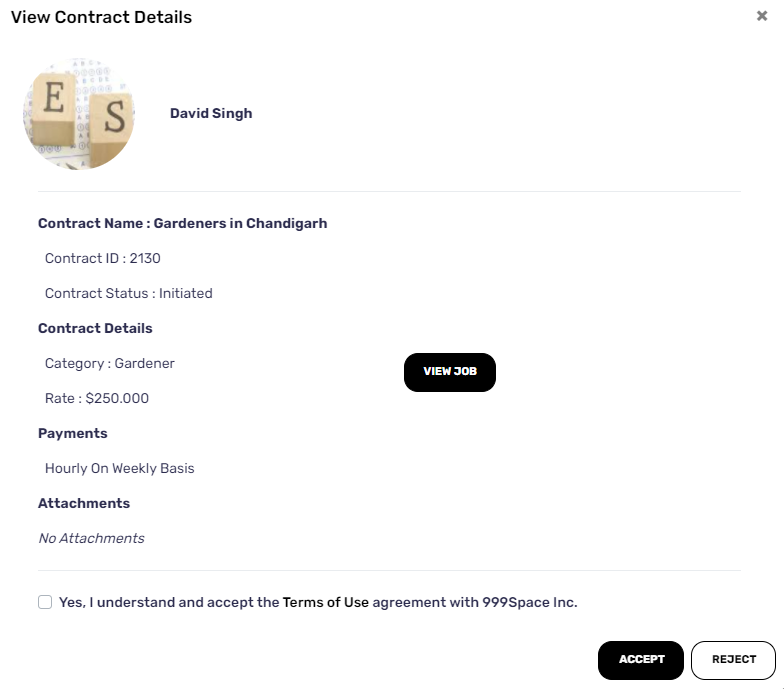

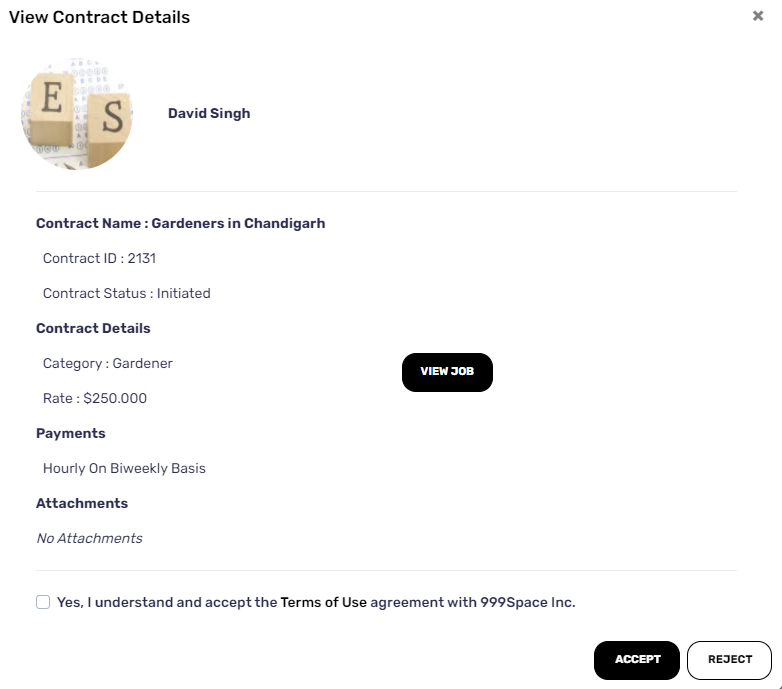

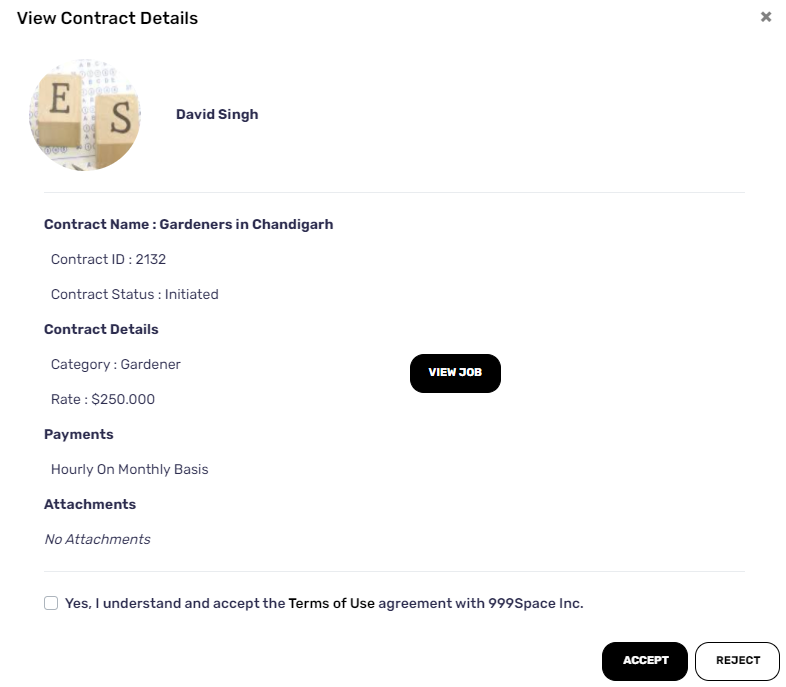

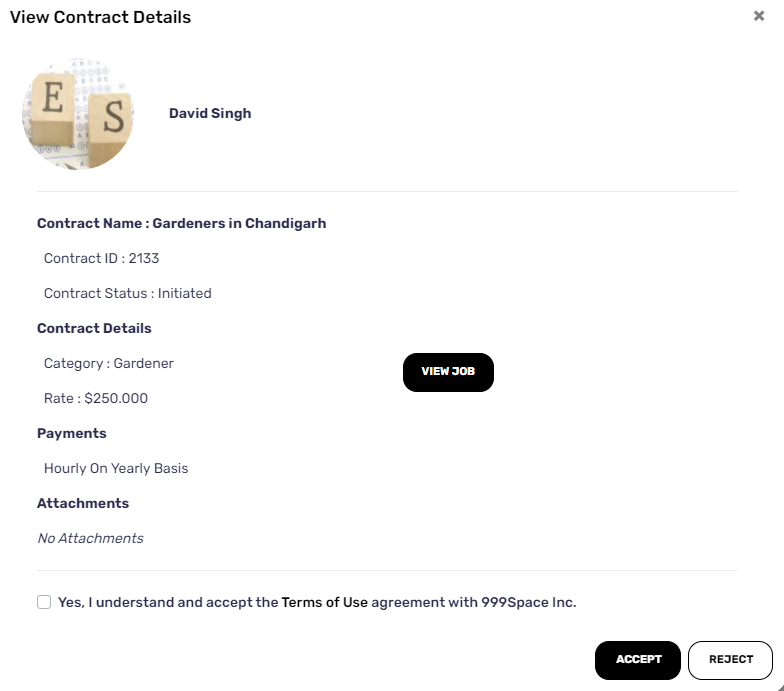

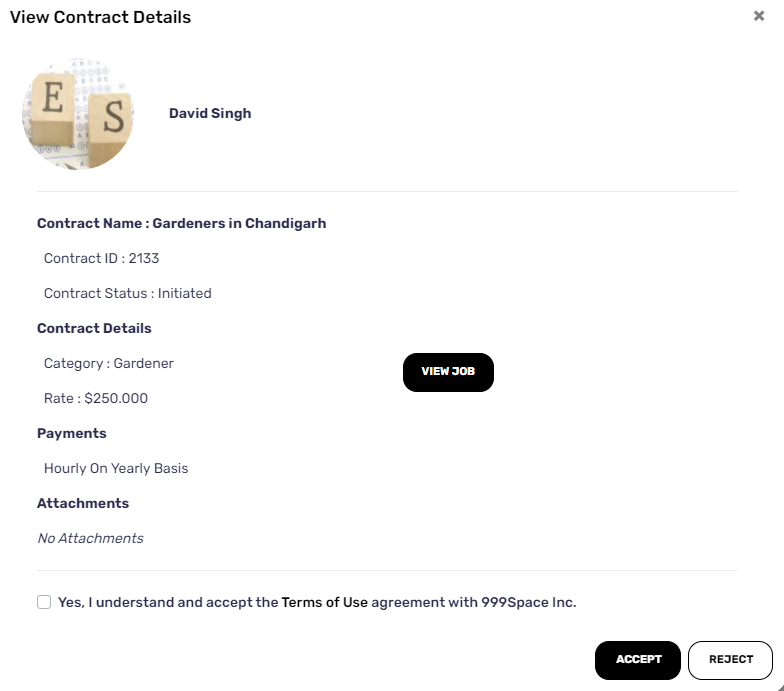

When client making a contract with provider, at that time we are making hold(lock on customer’s card or not charging at same time). Payment will be deducted or cancel on the basis of Accept/Reject action by provider. Up to 6th day, if contract is not started or rejected by provider, it will auto rejected by system can cancel all payments.

FixedFixed type of payment having fixed amount occur on manual or reccurring basis.

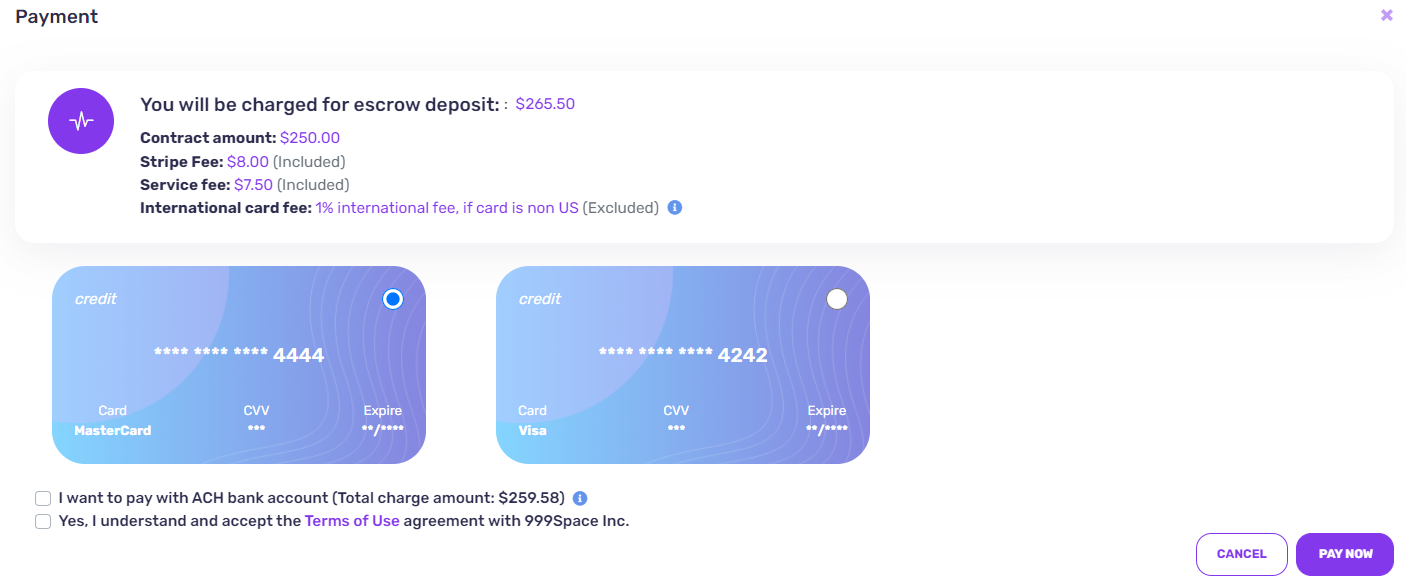

1. Fixed (One time)

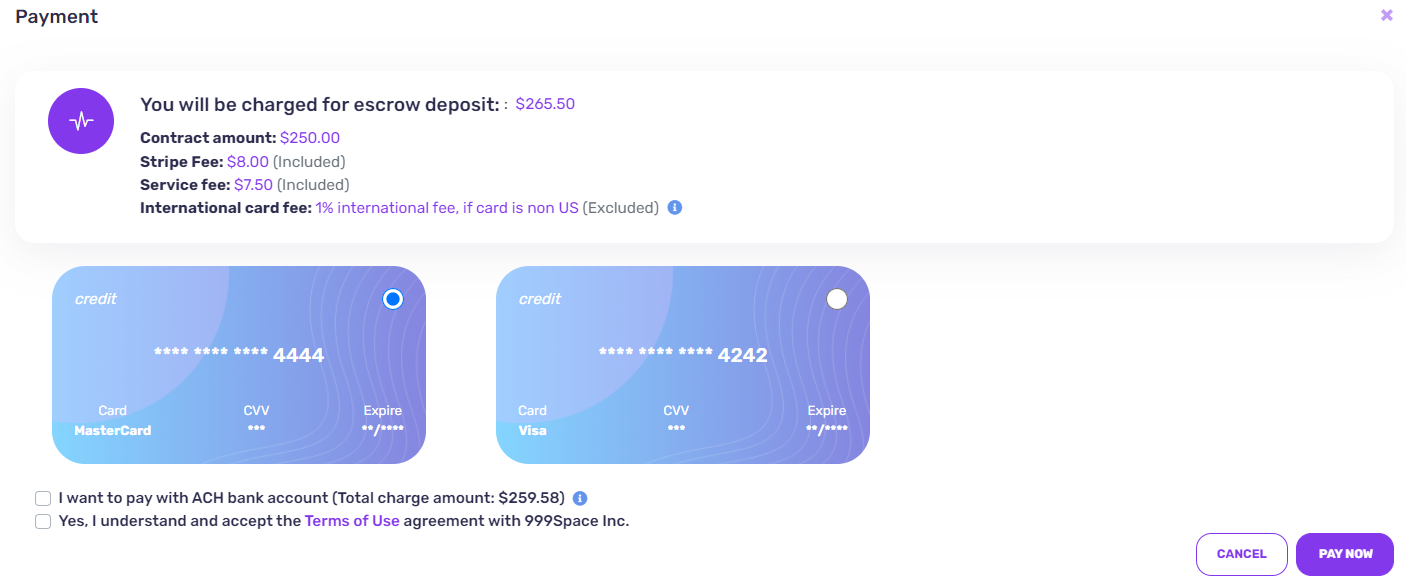

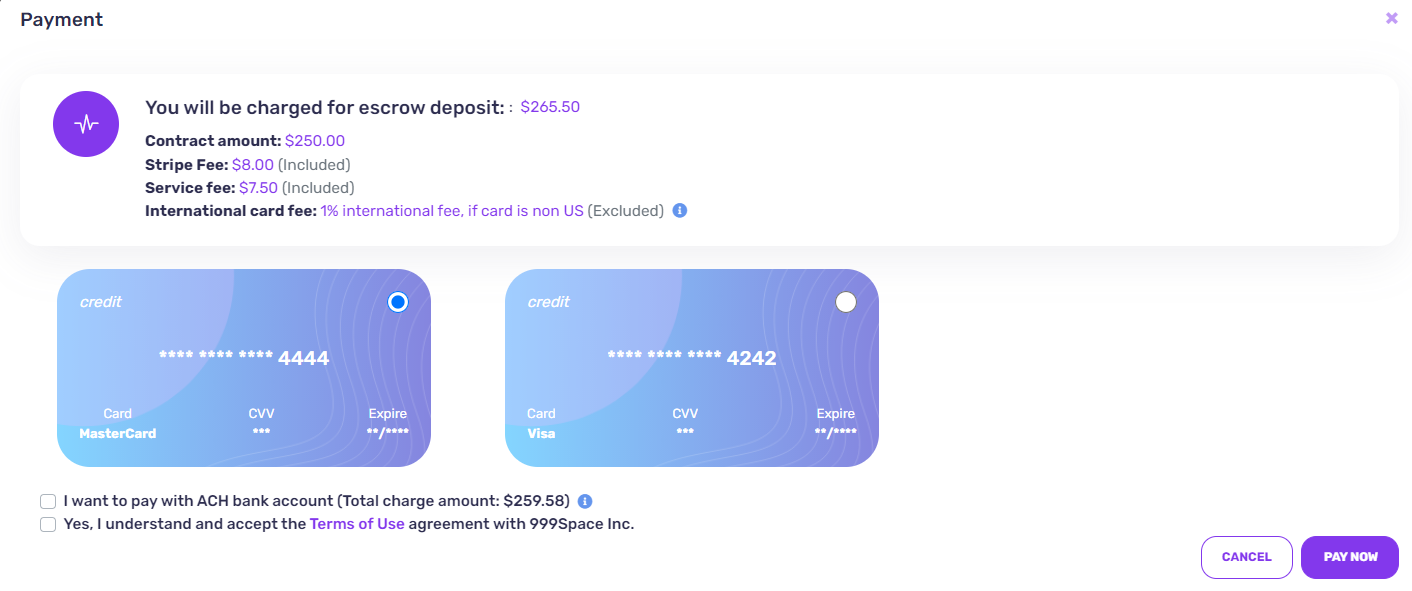

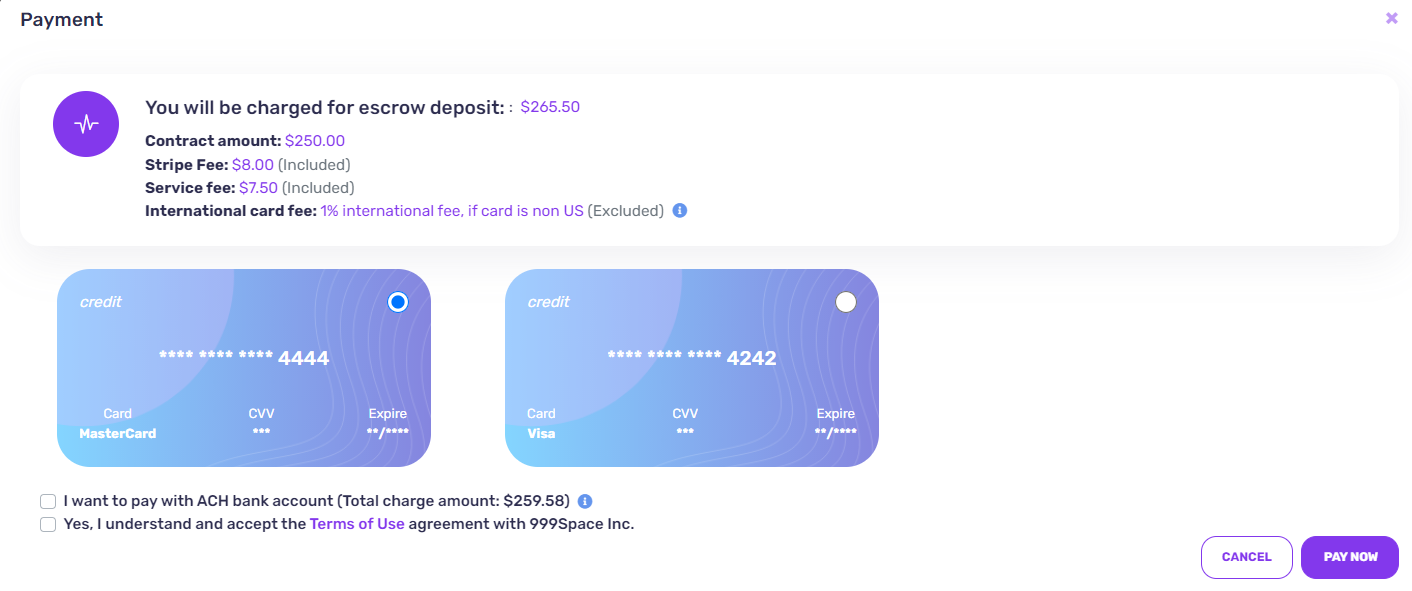

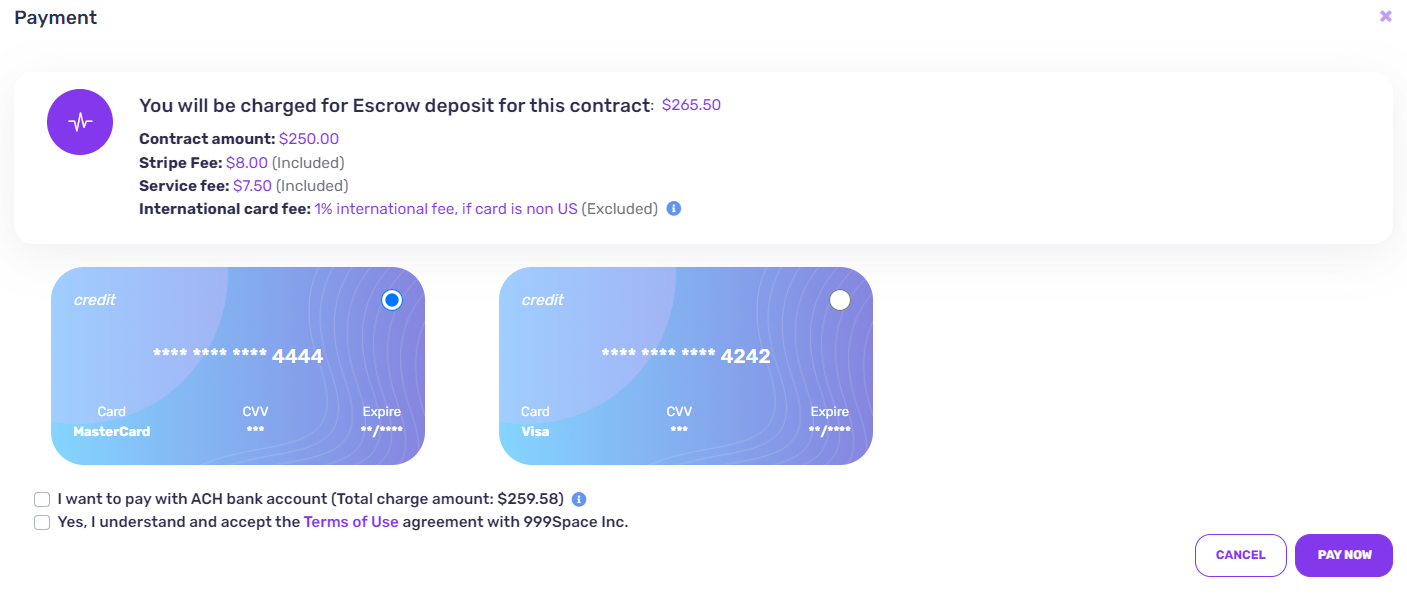

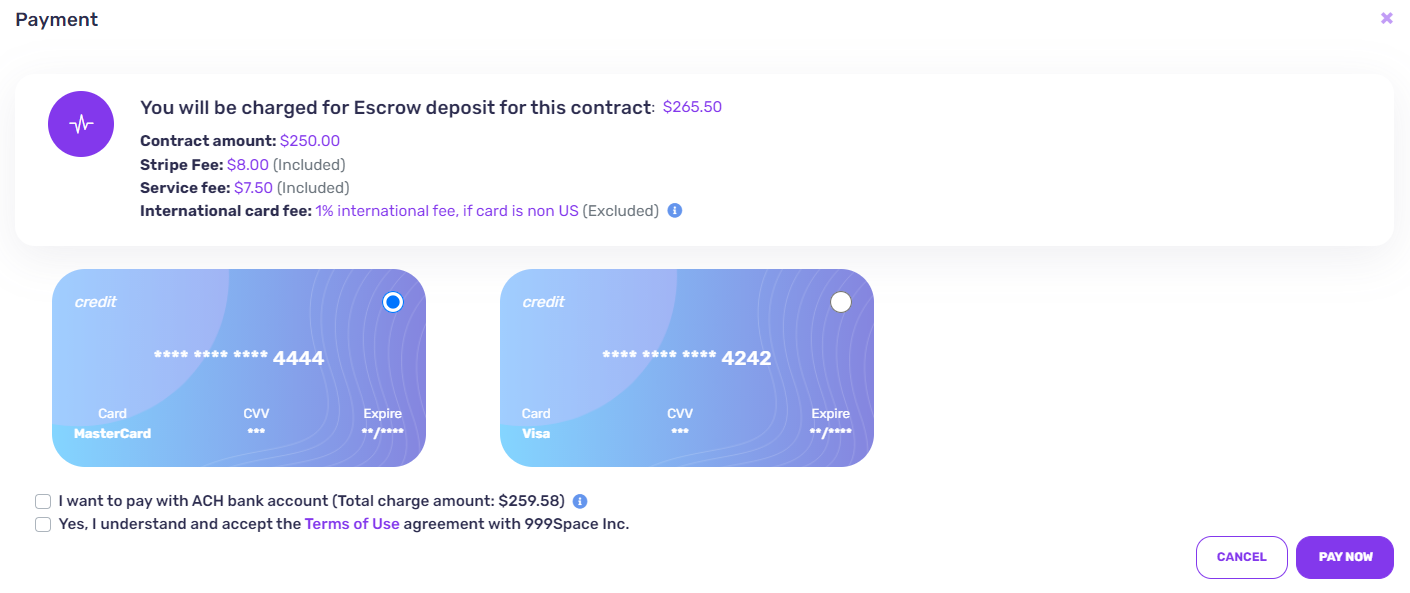

This is one time fixed amount of payment. When client is making contract he/she needs to put that amount in escrow. For example

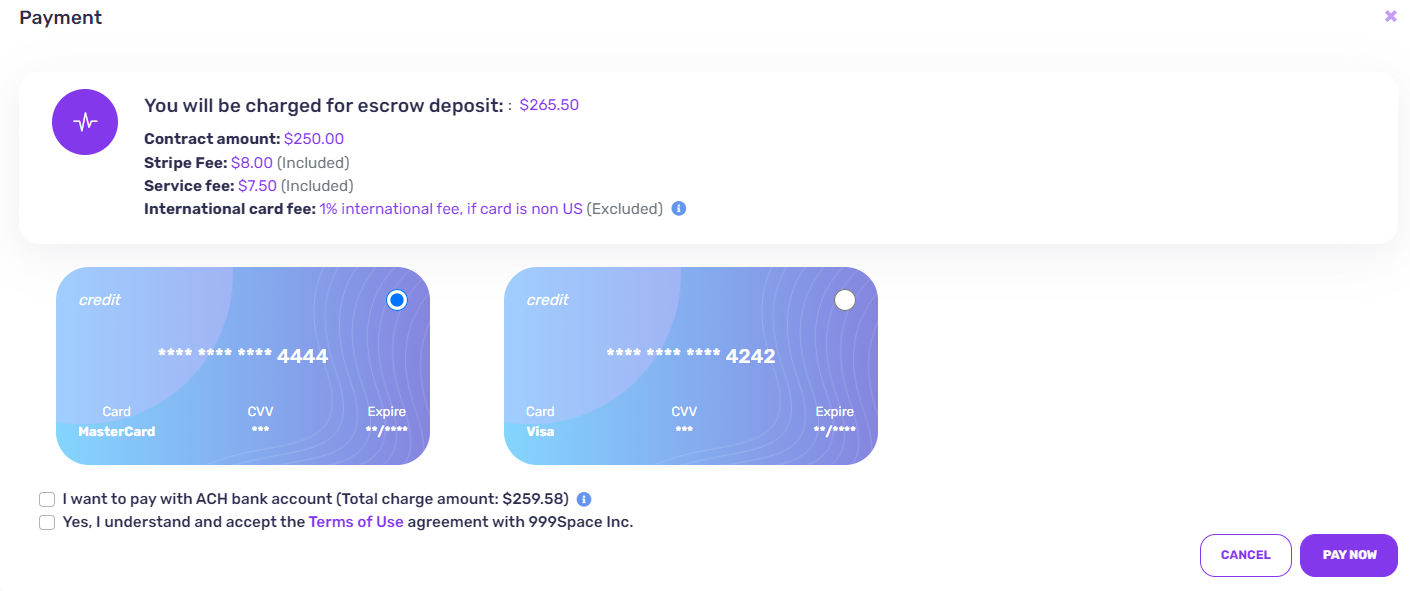

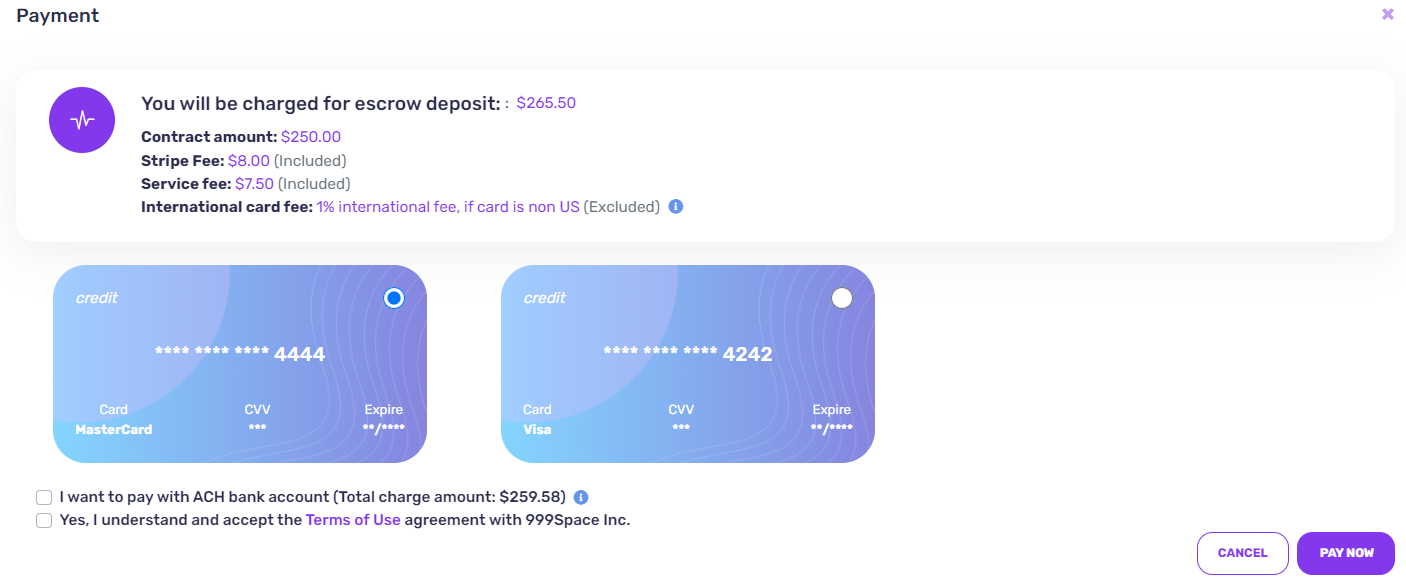

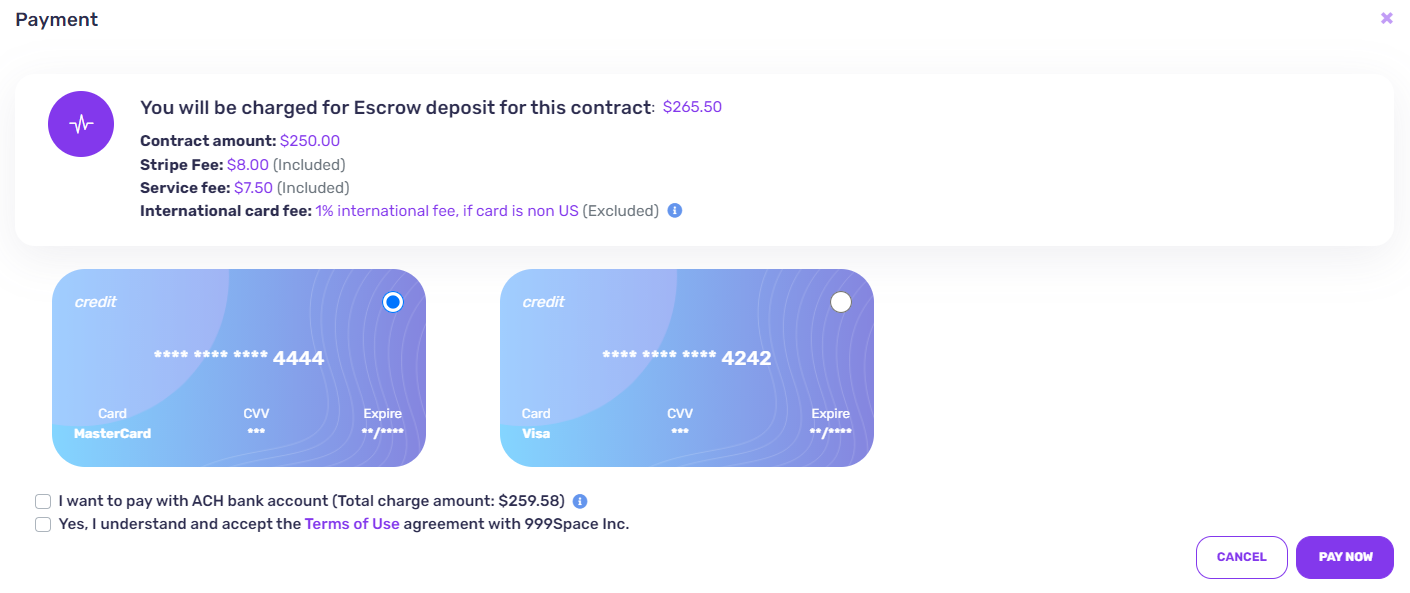

Contract amount: $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Contract amount - payout charges (approx 1.25%)

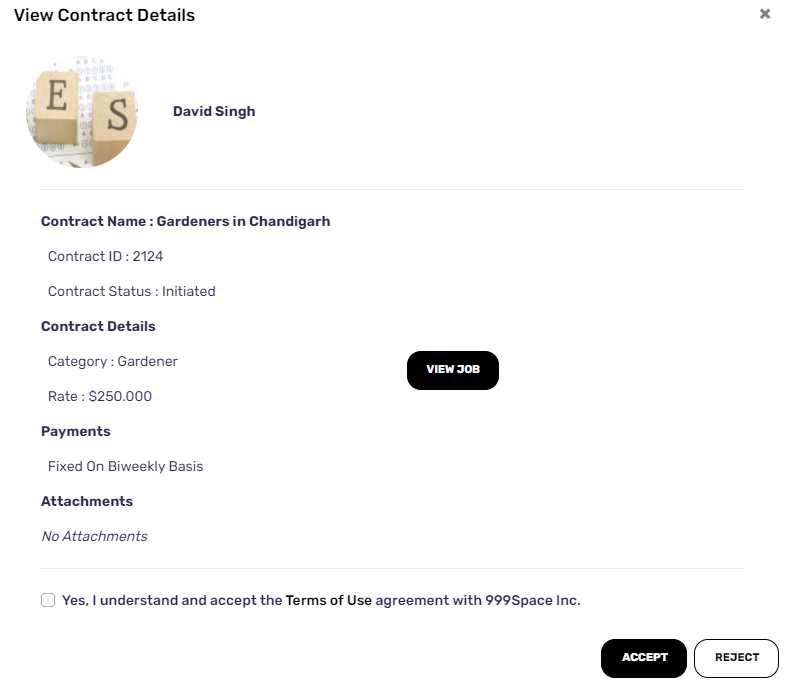

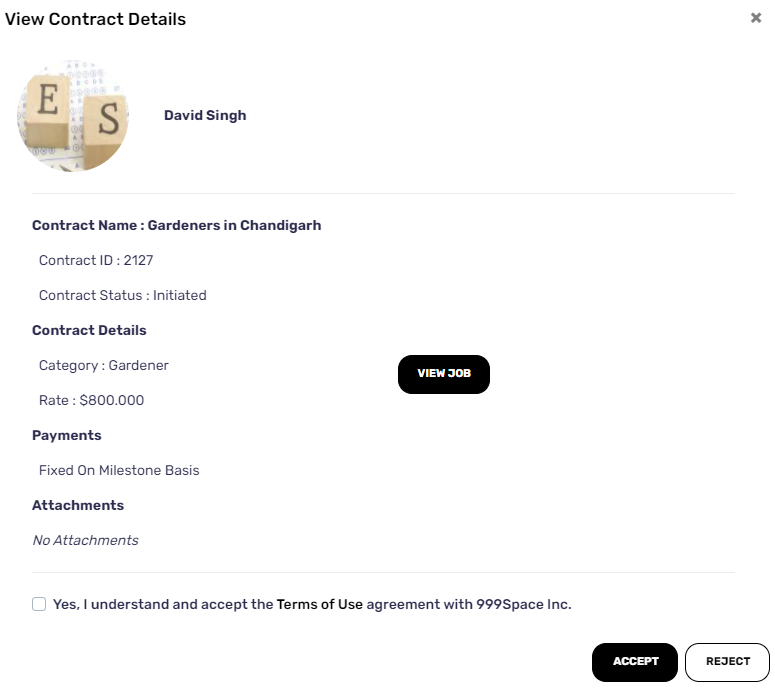

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client at the time of contract made, then card locked amount is captured: $265.50 (1% international fee, if card is non US (Excluded)) will be charged/confirmed from client, after 3-4 (depend upon the country and bank) this payment is

available for payout. Client can see the date their for when that amount is payable. Client can release that payment after requested by provider.

after available date.

2. If contract is selected to pay by ACH bank account by client, when provider accept that contract a ACH transaction from default ACH bank account is initiated,

and when this payment is successfull the card hold amount is unlocked.

If this payment is failed, then contract is paused if no payment is in escrow. Client can initiate new transaction regarding that failed payment after successfull transaction client and provider can resume the contract.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

When client payout that payment, provider will be credited with Total: ($250.00 - payout charged) after some days in their connected bank.

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled (Amount: $265.50 (1% international fee, if card is non US (Excluded))) or money will not deducted from client side.

2. Fixed (Daily)

This is recurring fixed amount of payment which happen on daily basis. When client is making contract he need to put that amount in escrow first. Client that contract. For example initiate

Contract amount: $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Contract amount - payout charges (approx 1.25%)

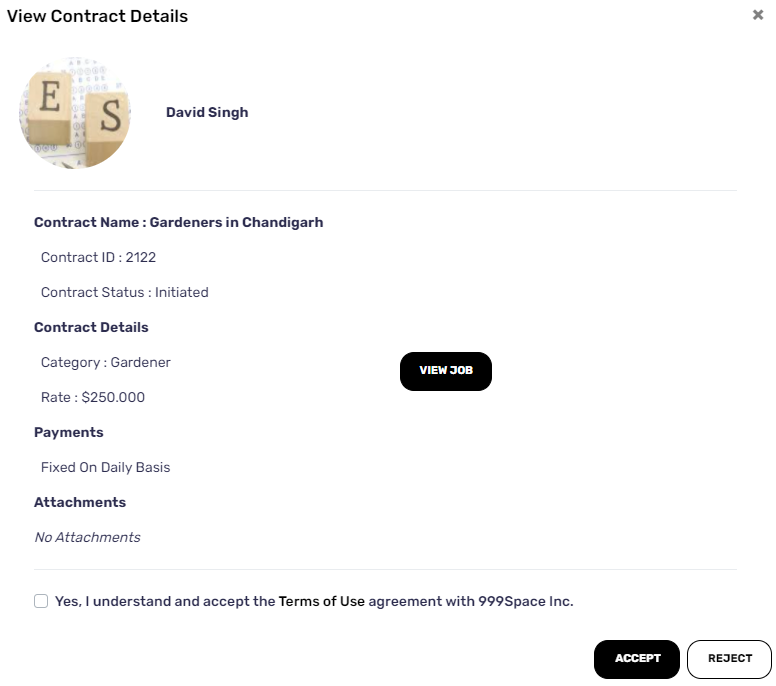

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured: $265.50 (1% international fee, if card is non US (Excluded)) will be charged/confirmed from client, after 3-4 (depend upon the country and bank) this payment is

available for payout. Client can see the date their for when that amount is payable. Client can release that payment after requested by provider

after available date.

2. If contract is selected to pay by ACH bank account by client, when provider accept that contract a ACH transaction from default ACH bank account is initiated,

and when this payment is successfull the card hold amount is unlocked.

For fixed (Daily) contract client will be charged automatically from default payment method, client choosed for futher transactions, if any payment is failed and no amount is in escrow at that time the contract will be paused. Client can initiated new payments regarding failed payments.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

If contract is rejected, all payment will be canceled (Amount: $265.50 (1% international fee, if card is non US (Excluded))) or money will not deducted from client side.

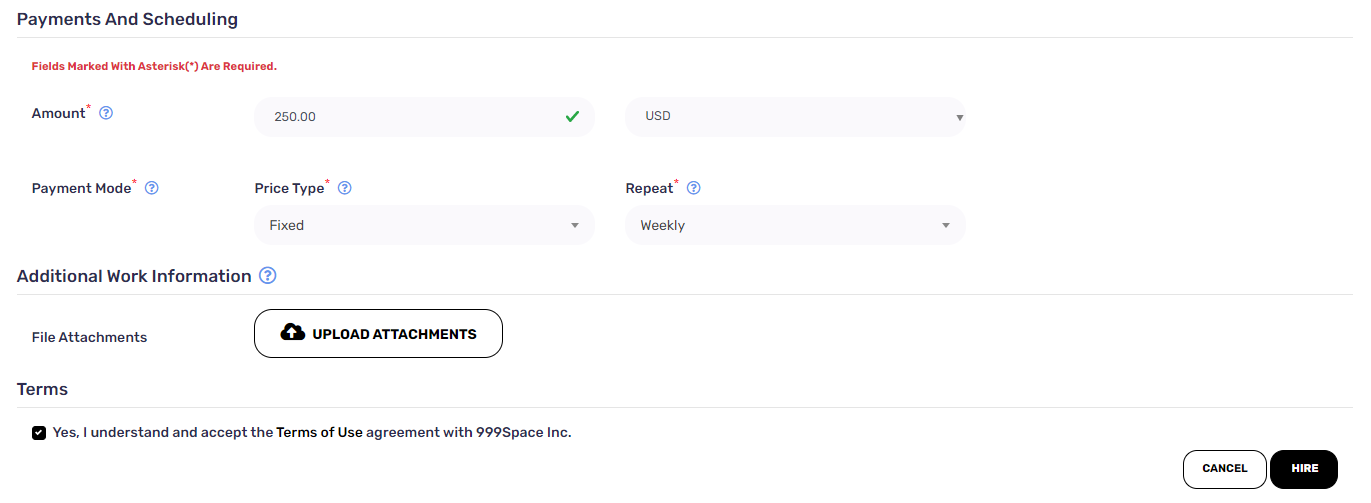

3. Fixed (Weekly)

This is recurring fixed amount of payment which happen on weekly basis. When client is making contract he need to put that amount in escrow. For example initiate

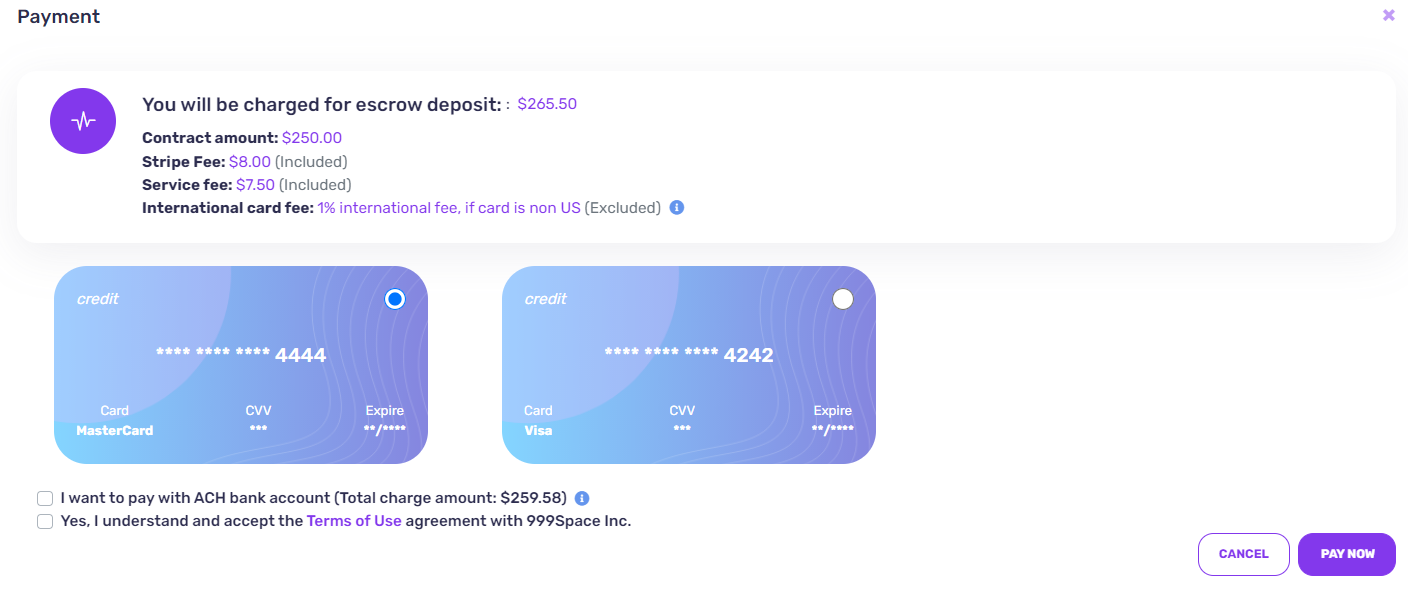

Contract amount: $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Contract amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured:$265.50 (1% international fee, if card is non US (Excluded)) will be charged/confirmed from client. When system automatically charge

next payment(Amount: $265.50 (1% international fee, if card is non US (Excluded))) and payout previous payment after week, provider will credited Total: in their connected bank.

2. If contract is selected to pay by ACH bank account by client, when provider accept that contract a ACH transaction from default ACH bank account is initiated,

and when this payment is successfull the card hold amount is unlocked. If this payment is failed with any reason then contract is paused if no payment is in escrow.

For fixed (Weekly) contract client will be charged automatically from default payment method he/she choosed for futher transactions, if any payment is failed and no amount is in escrow the contract will be paused. Client can initiated new payments regarding failed payments.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

If contract is rejected, all payment will be canceled (Amount: $265.50 (1% international fee, if card is non US (Excluded)) or money will not deducted from client side.

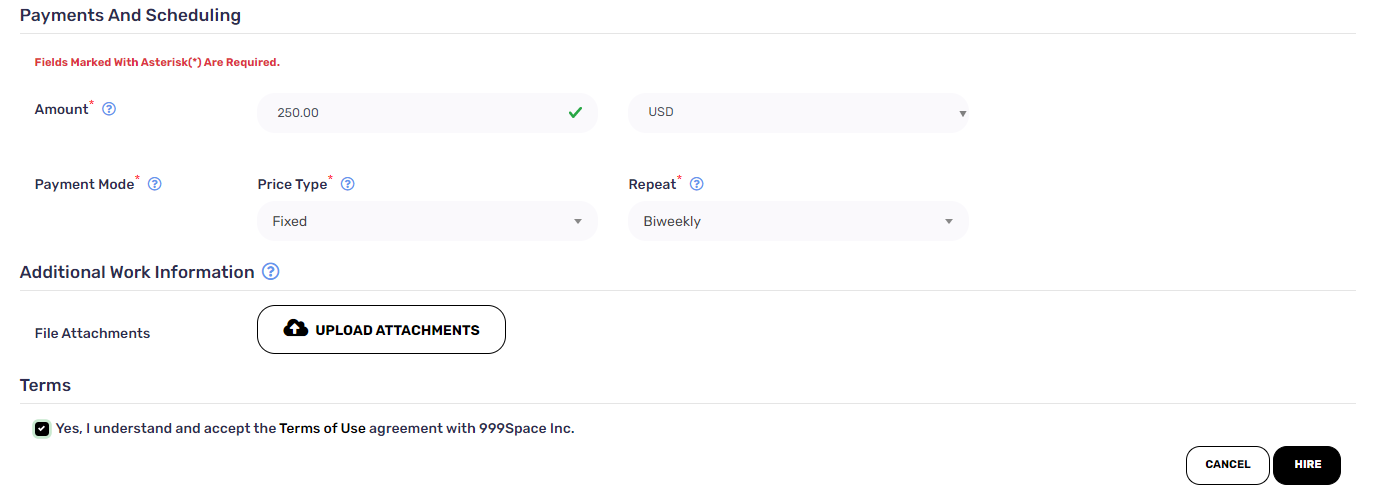

4. Fixed (Biweekly)

This is recurring fixed amount of payment which happen after 14 days basis. When client is making contract he need to put that amount in escrow. For example initiate

Contract amount: $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = contract amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured: $265.50 (1% international fee, if card is non US (Excluded) will be charged/confirmed from client. When system automatically charge next

payment(Amount: $265.50 (1% international fee, if card is non US (Excluded)) and payout previous payments after 14 days, provider will credited Total: (Contract amount - payout charges (approx 1.25%)) in their connected bank.

2. If contract is selected to pay by ACH bank account by client, when provider accept that contract a ACH transaction from default ACH bank account is initiated,

and when this payment is successfull the card hold amount is unlocked. If this payment is failed with any reason then contract is paused if no payment is in escrow.

For fixed (Biweekly) contract client will be charged automatically from default payment method he/she choosed for futher transactions, if any payment is failed and no amount in escrow contract will be paused. Client can initiated new payments regarding failed payments.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

If contract is rejected, all payment will be canceled (Amount: $265.50 (1% international fee, if card is non US (Excluded)) or money will not deducted from client side.

5. Fixed (Monthly)

This is recurring fixed amount of payment which happen after 30 days basis. When client is making contract he need to put that amount in escrow. For example initiate

Contract amount: $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Contract amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured: $265.50 (1% international fee, if card is non US (Excluded) will be charged/confirmed from client. When system automatically charge

next payment(Amount: $250.00) and payout previous payment after 30 days, provider will credited Total: (Contract amount - payout charges (approx 1.25%)) in their connected bank.

2. If contract is selected to pay by ACH bank account by client, when provider accept that contract a ACH transaction from default ACH bank account is initiated,

and when this payment is successfull the card hold amount is unlocked. If this payment is failed with any reason then contract is paused if no payment is in escrow

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

If contract is rejected, all payment will be canceled (Amount: $265.50 (1% international fee, if card is non US (Excluded)) or money will not deducted from client side.

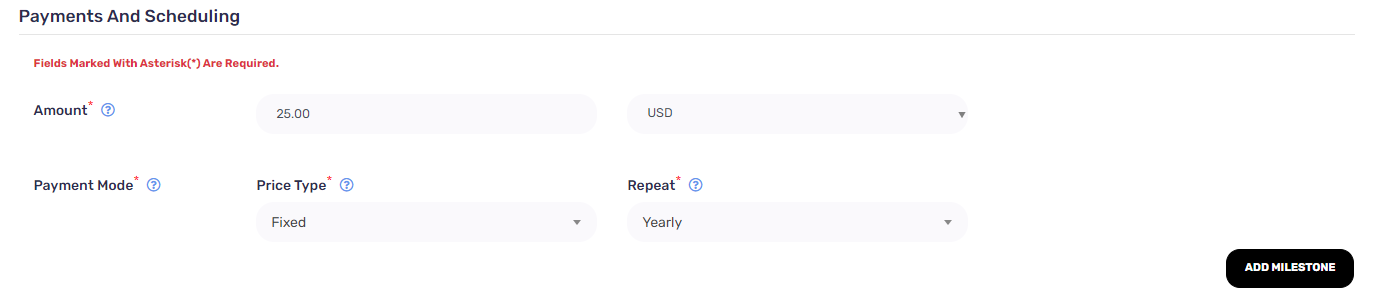

6. Fixed (Yearly)

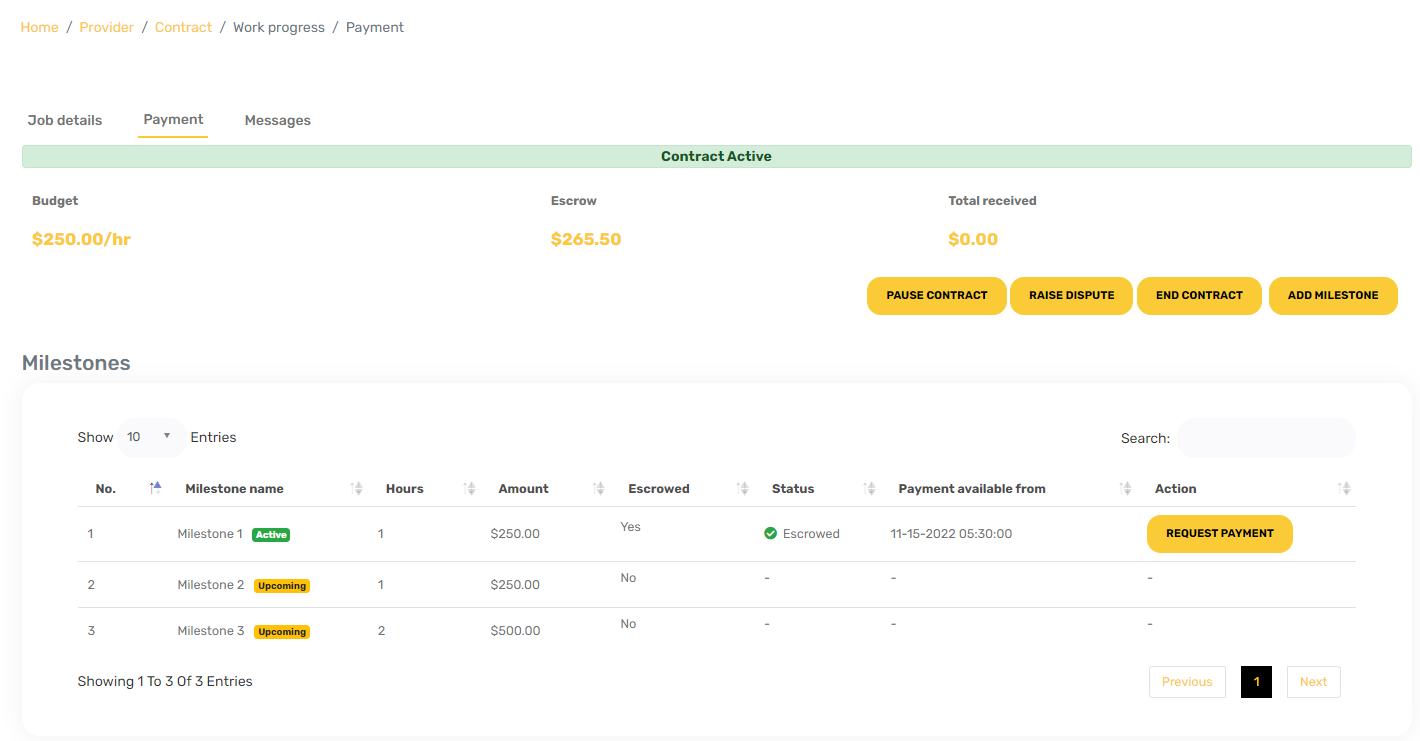

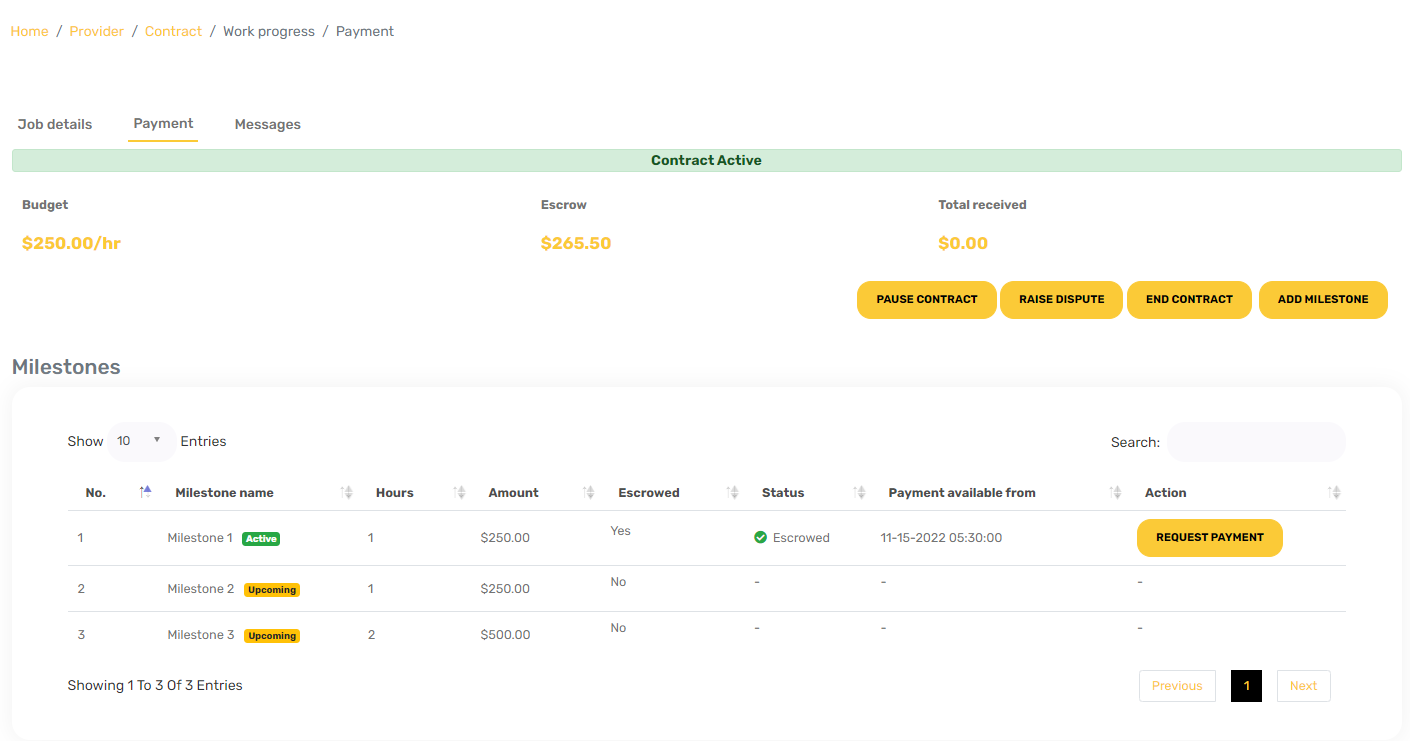

This is manual fixed amount of payment basis .When client is making contract he/she needs to put first milestone amount in escrow. For example initiate

a. Milestone-1 : $250

b. Milestone-2 : $150

c. Milestone-3 : $100

Client can pay by card or ACH bank account (if contract currency support ACH direct debit transfer)

Milsestone-1 for $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Milsestone amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured:$250 will be

charged/confirmed from client. payment will be released after work done and requested from provider,

provider will credited Total: (milestone amount - payout charges) in their connected bank.

2. If contract is selected to pay by ACH bank account by client, when the provider accept that contract a ACH transaction from default ACH bank account is initiated,

and when this payment is successfull the card hold amount is unlocked. If this payment is failed with any reason then contract is paused if no payment is in escrow.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

If contract is rejected, all payment will be canceled (Amount: $250.00) or money will not deducted from client side.

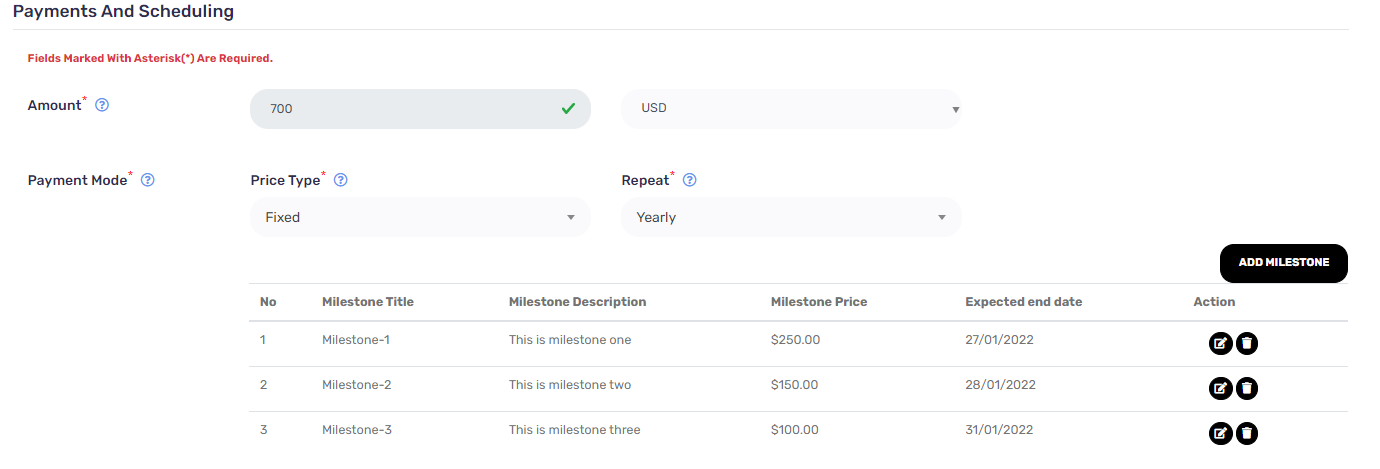

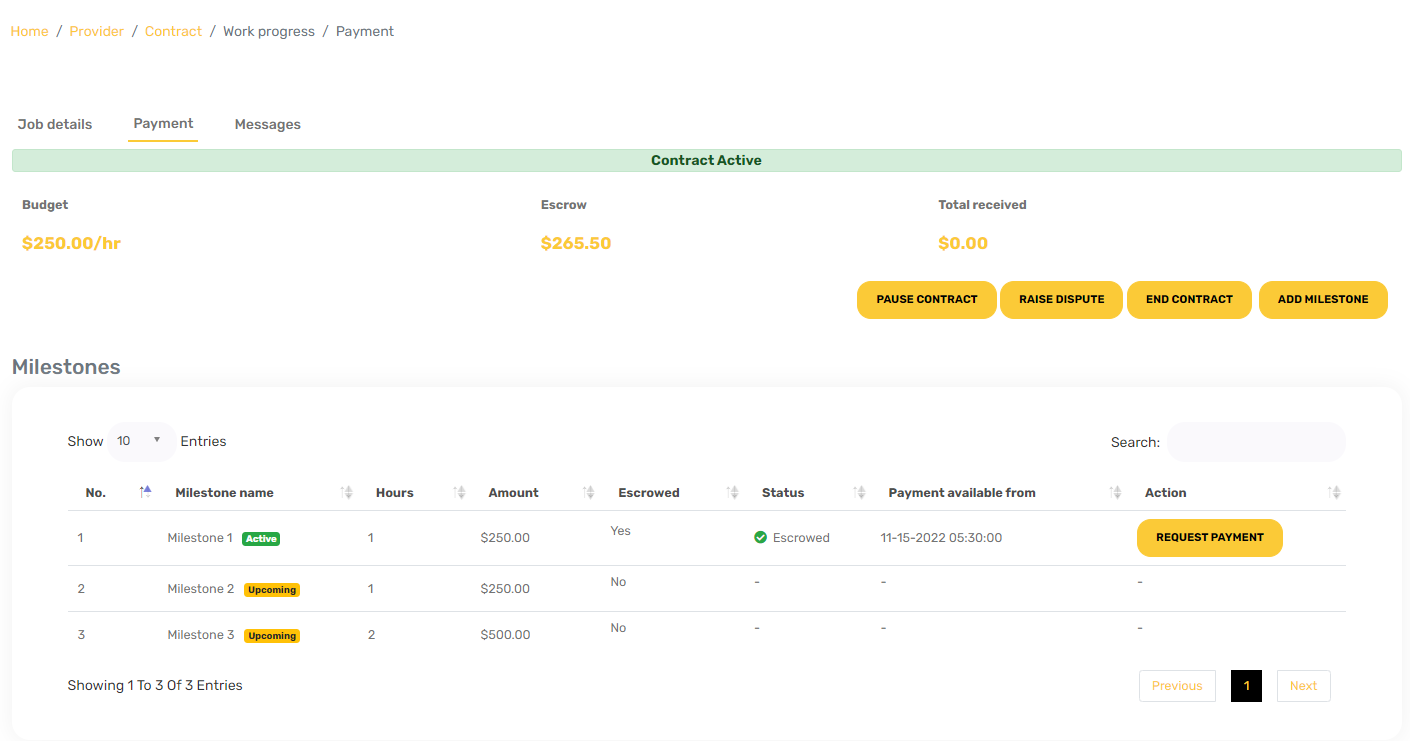

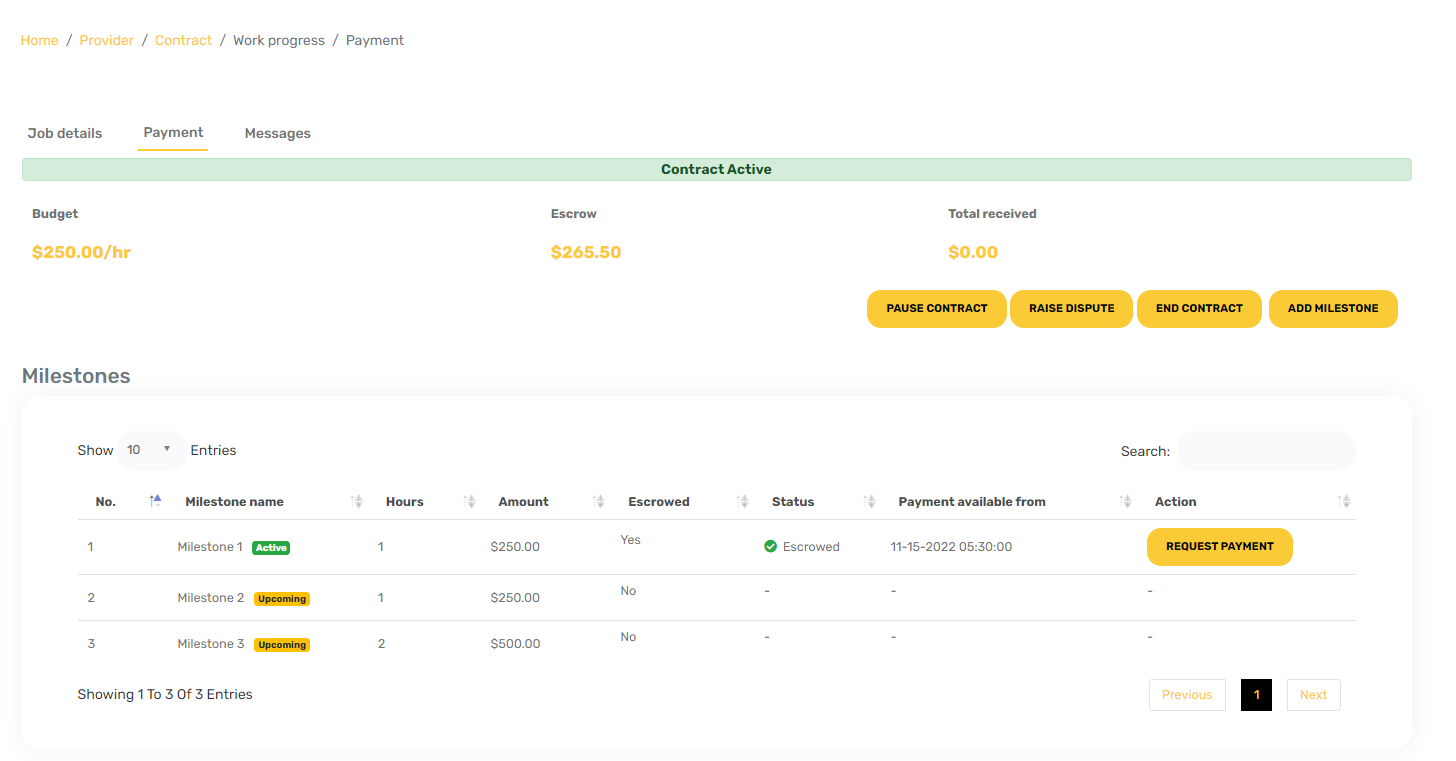

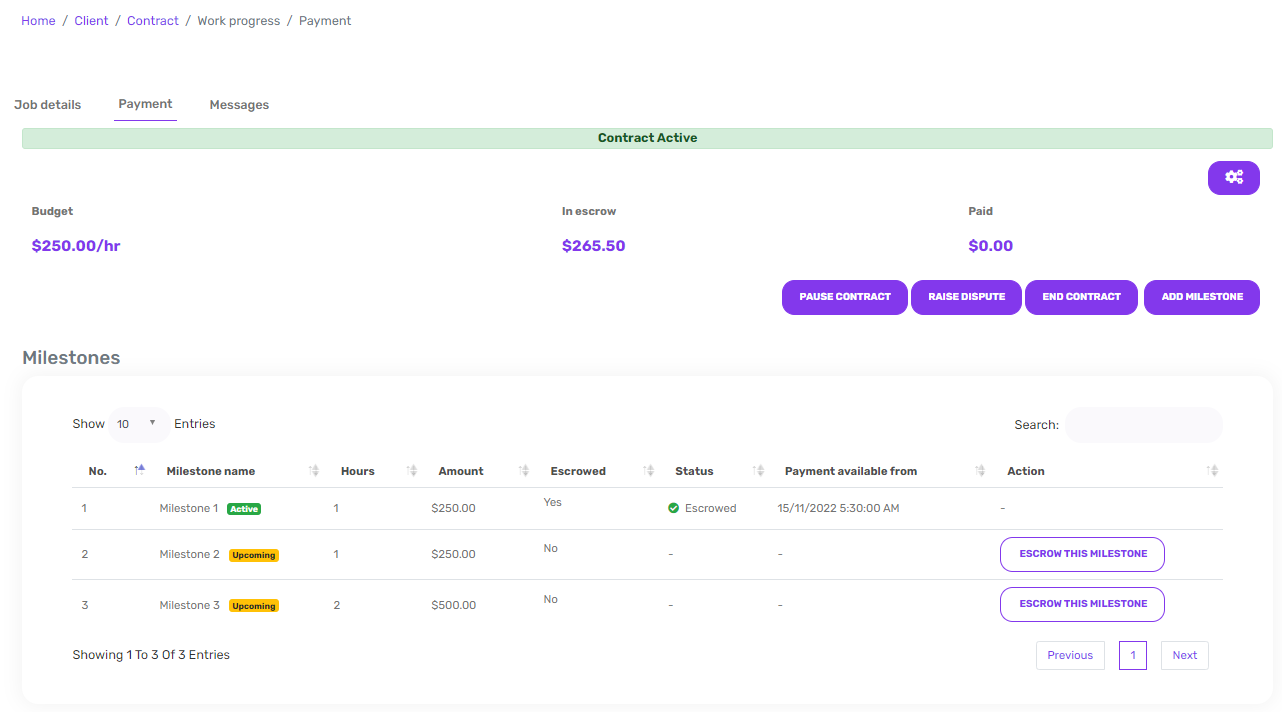

7. Fixed (Milestone)

This is manual fixed amount of payment basis .When client is making contract he need to put first milestone amount in escrow. For example initiate

a. Milestone-1 : $250

b. Milestone-2 : $150

c. Milestone-3 : $100

Milsestone-1 for $250

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Milestone amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured:

$250 will be charged/confirmed from client. Payment will be released after work done and

requested from provider, provider will credited Total: $237.50 in their connected bank.

2. If contract is selected to pay by ACH bank account by client, when the provider accept that contract a ACH transaction

from default ACH bank account is initiated, and when this payment is successfull the card hold amount is unlocked.

Payment will be released after work done and requested from provider, provider will credited Total: $237.50

in their connected bank. If this payment is failed with any reason then contract is paused if no payment is in escrow.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

If contract is rejected, all payment will be canceled (Amount: $250.00) or money will not deducted from client side.

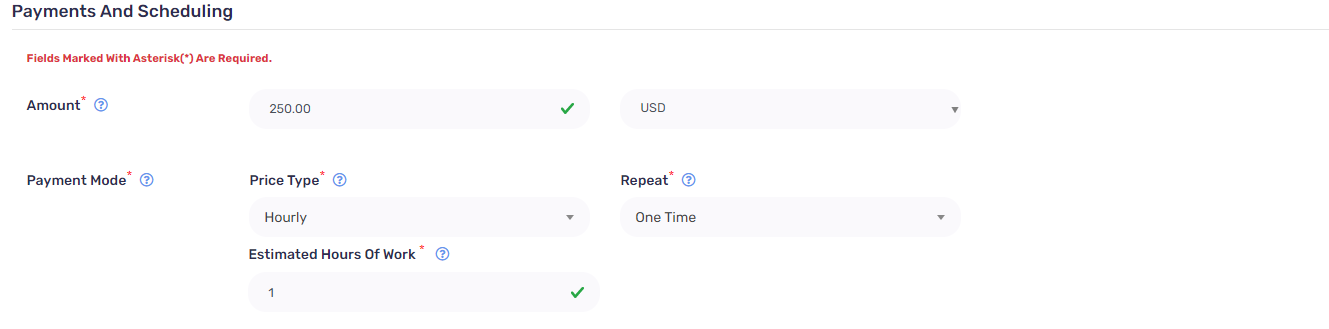

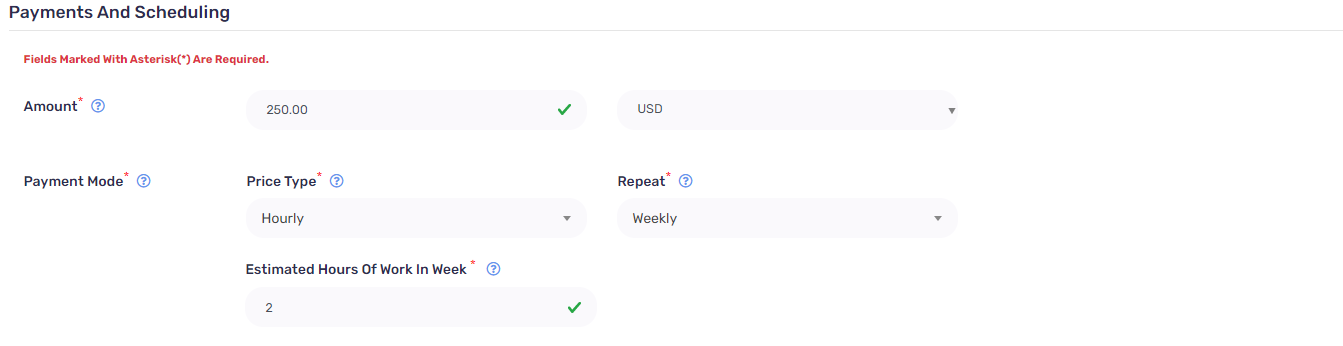

Hourly

Hourly type of payment having amount calculated on basis of hours occur on manual or reccurring basis.

1. Hourly (One time)

This is one time fixed amount payment based on hours. When client is making contract he need to put that amount in escrow. Client initiate that contract. For example

Contract is for $250.00

Hours:1

Amount: $250.00 * 1= $250.00

You will be charged for escrow deposit: $265.50

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Milestone amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

1. If contract is selected to pay by card by client then card locked amount is captured: $265.50 will be charged/confirmed from client, after 3-4 days(depend upon the country and bank) this payment is

available for payout. Client can see the date their for when that amount is payable. He/she can release that payment after requested by provider.

2. If contract is selected to pay by ACH bank account by client, when the provider accept that contract a ACH transaction

from default ACH bank account is initiated, and when this payment is successfull the card hold amount is unlocked.

Payment will be released after work done and requested from provider, provider will credited Total: $237.50

in their connected bank. If this payment is failed with any reason then contract is paused if no payment is in escrow.

(Note: If contract currency supports ACH direct debit transfer than users can opt ACH bank account payment option)

When client payout that payment, provider will credited Total: $237.50 after some days in their connected bank.

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled (Amount: $250.00) or money will not deducted from client side.

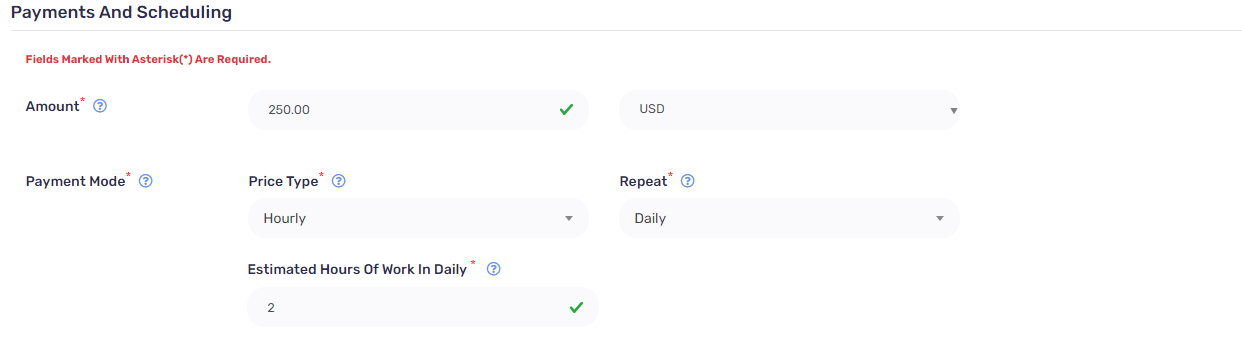

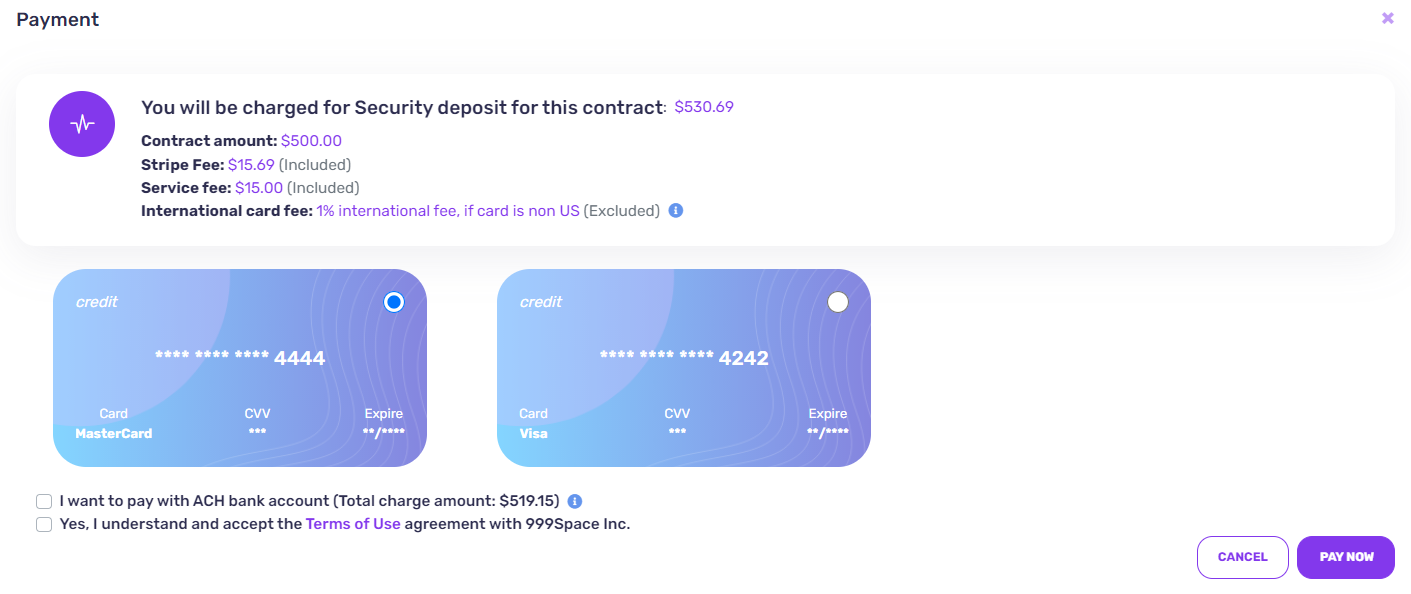

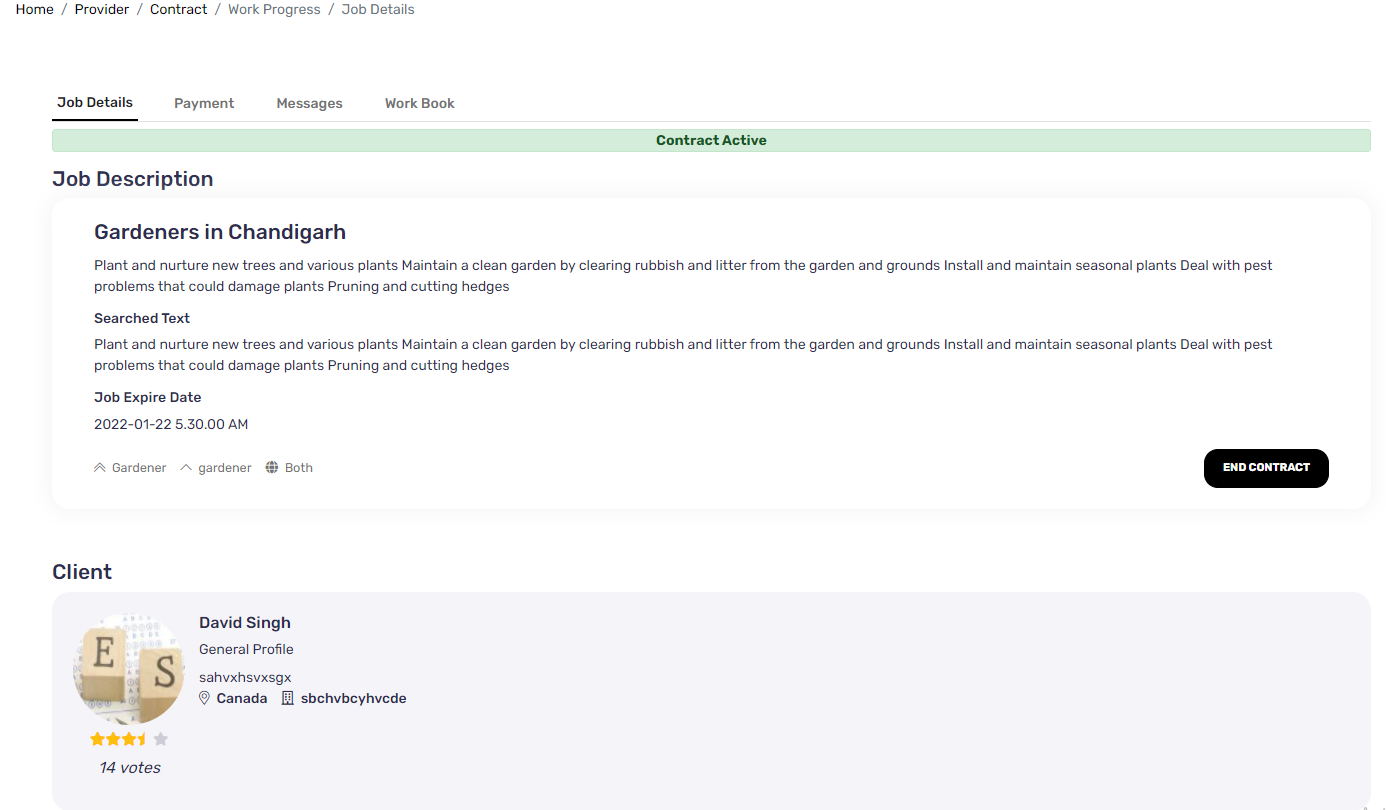

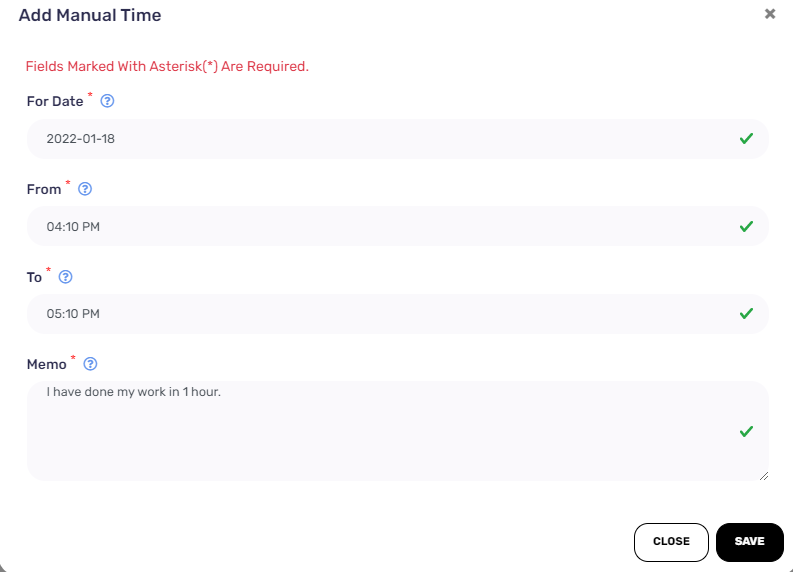

2. Hourly (Daily)

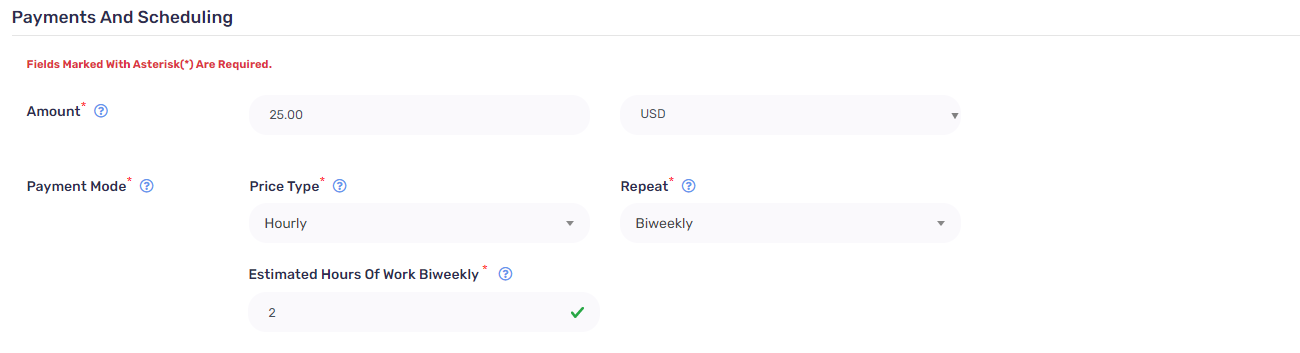

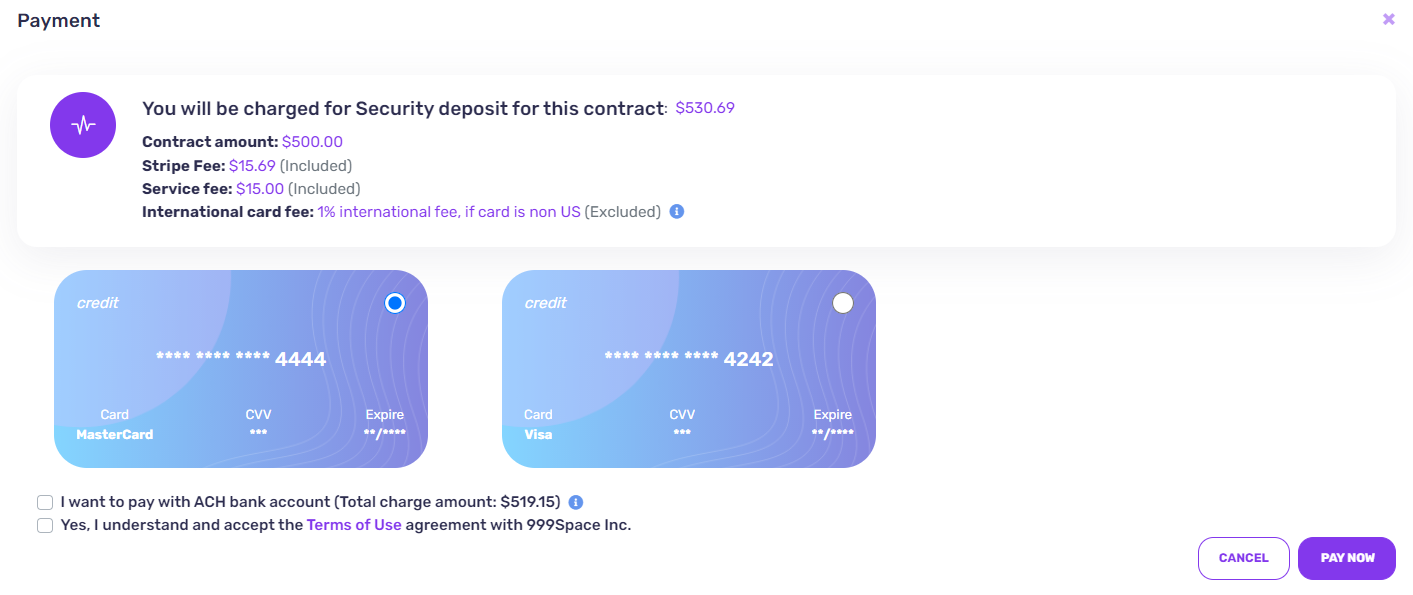

This is recurring fixed amount of payment which happen on daily based on hours entered by provider .When client is making contract he need to put some amount basis on some estimated hours. These hours are used for security purpose, which will be fully refundable and not actually taking money from client, it is just locked payment on client’s card . For example initiate

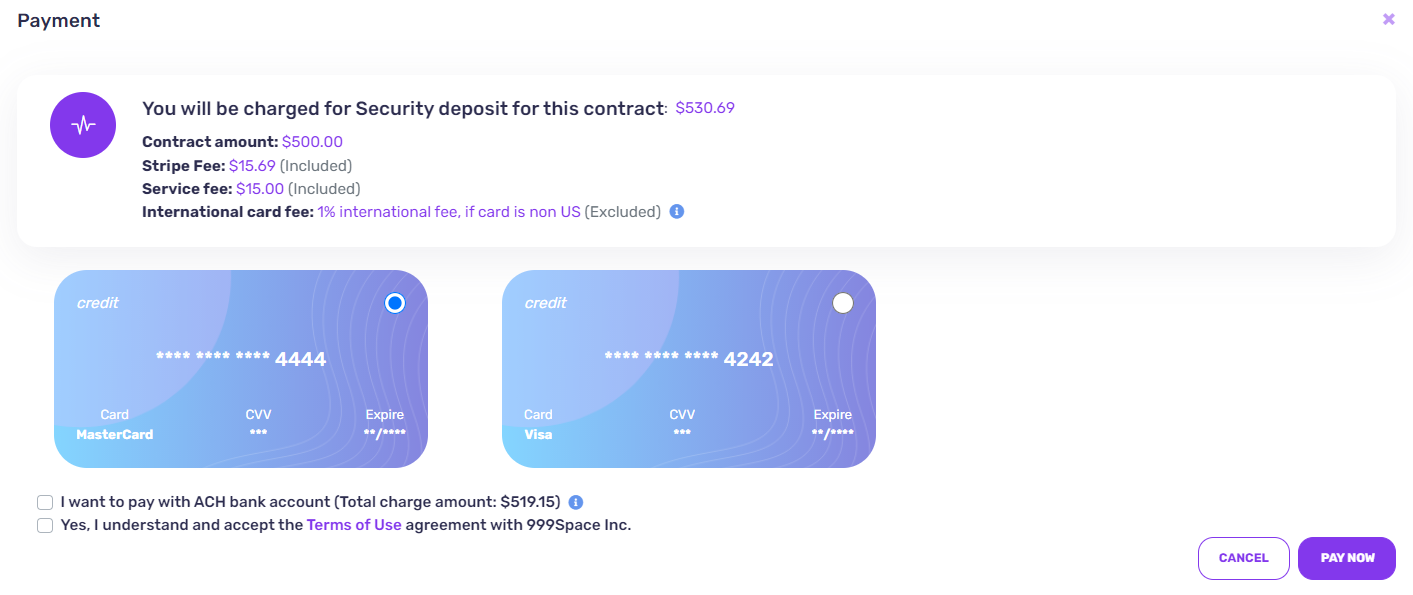

Contract is for $250.00

Security Amount: $250.00 * 2 hours(estimated hour provider will work).

Stripe Fee: $15.69 (Included)

Service fee: $15.00 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Total security: $530.69(approx.) (this payment used as security as a part of escrow).

So when provider see that contract. He can either do Accept/Reject.

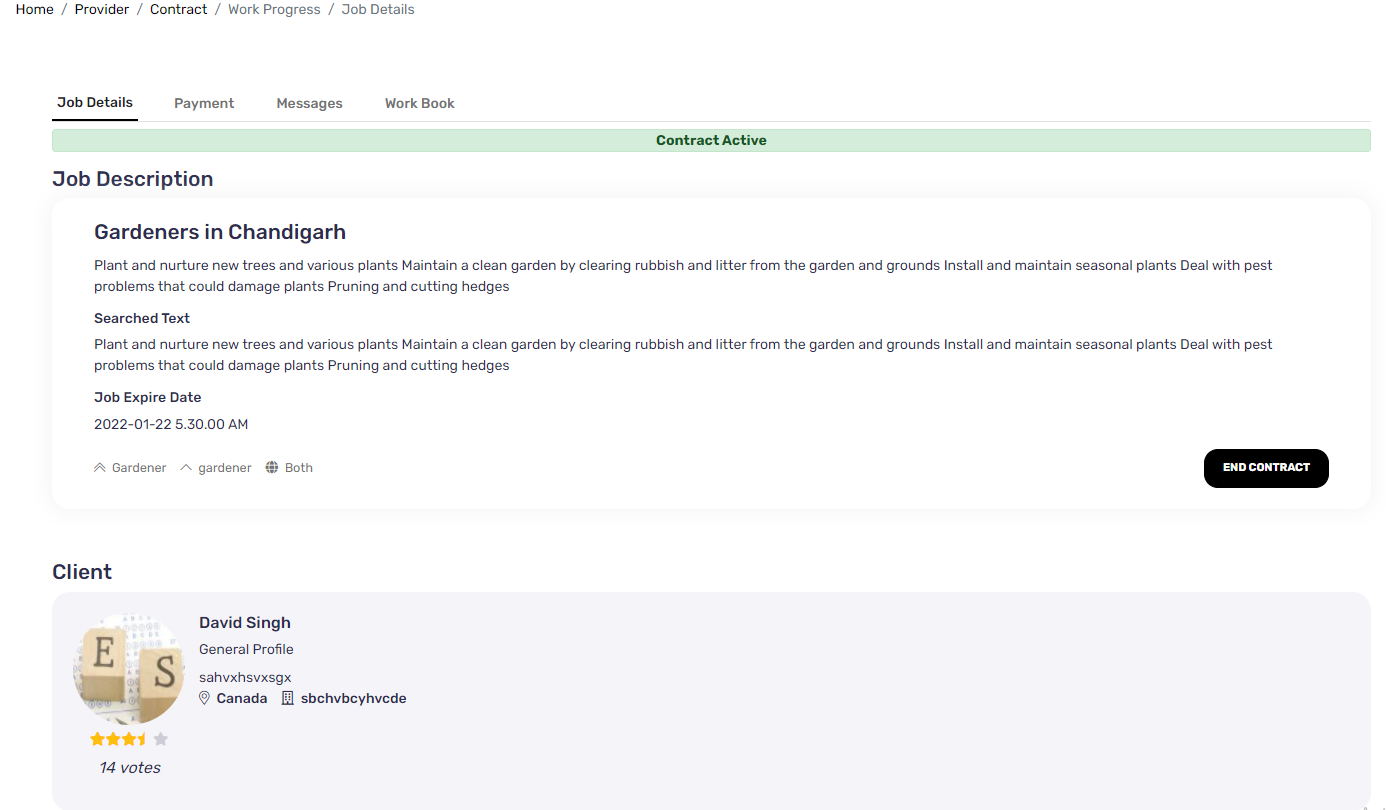

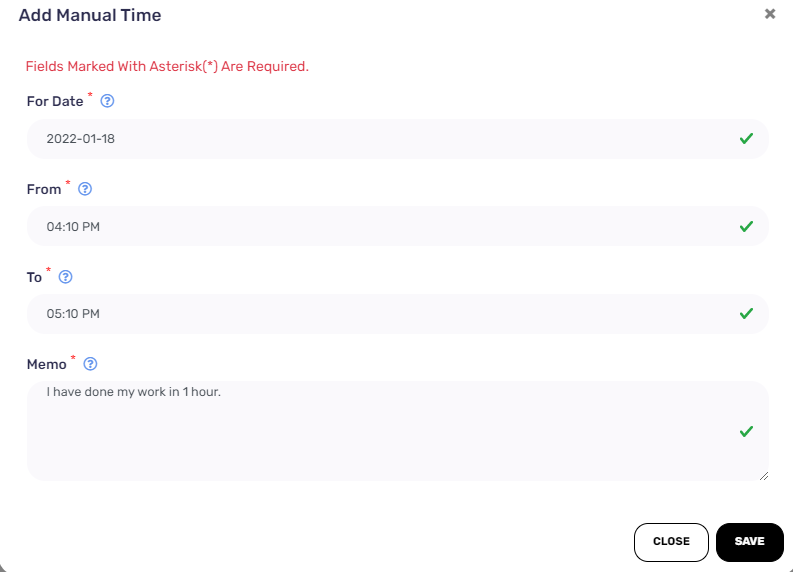

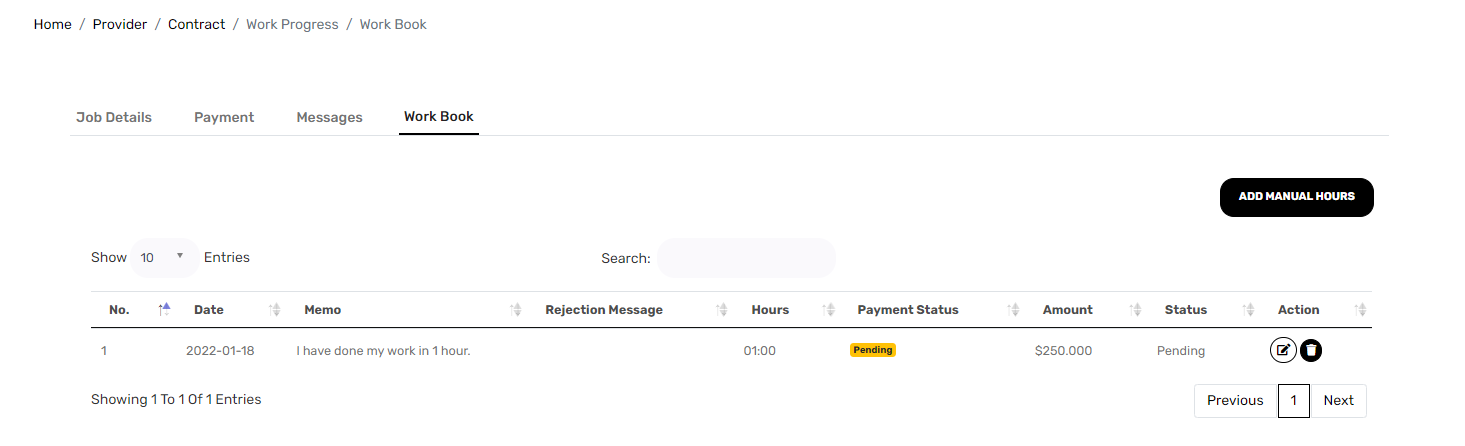

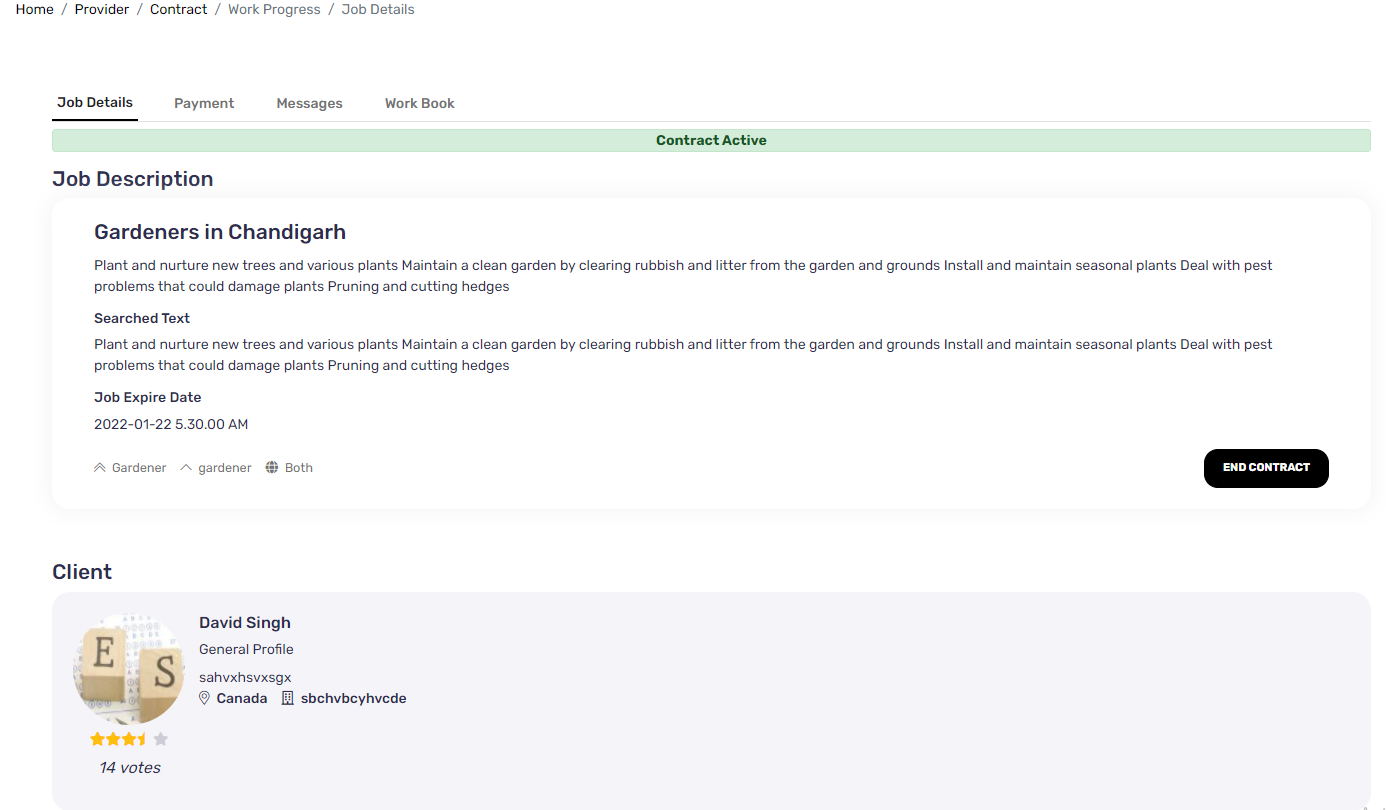

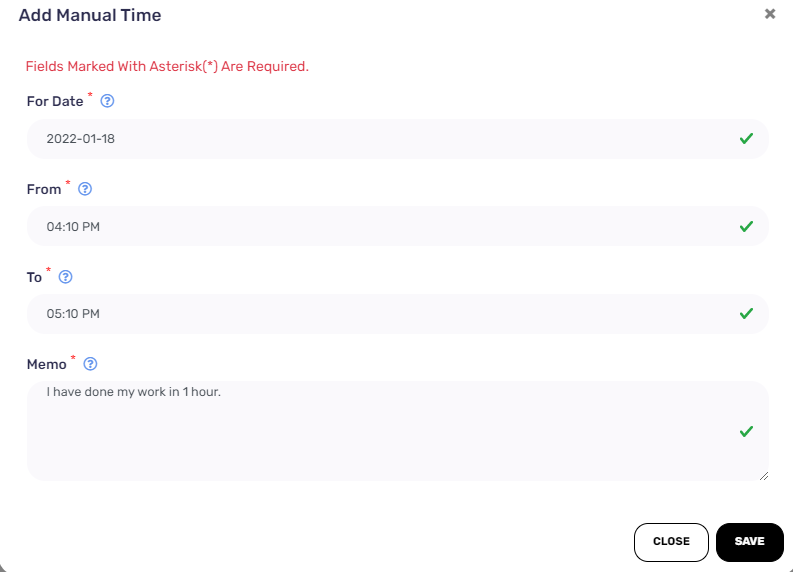

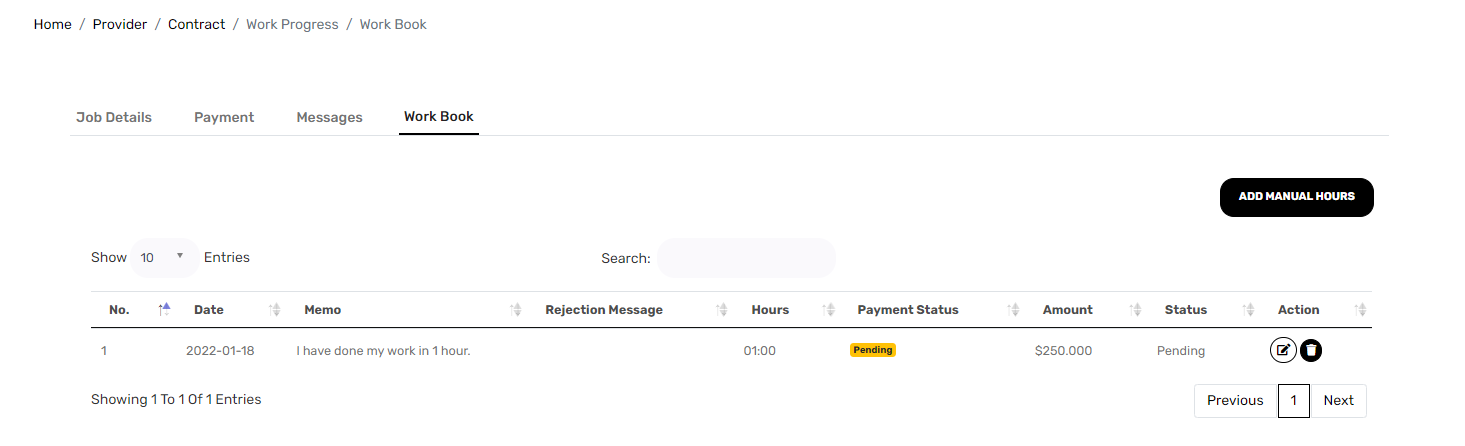

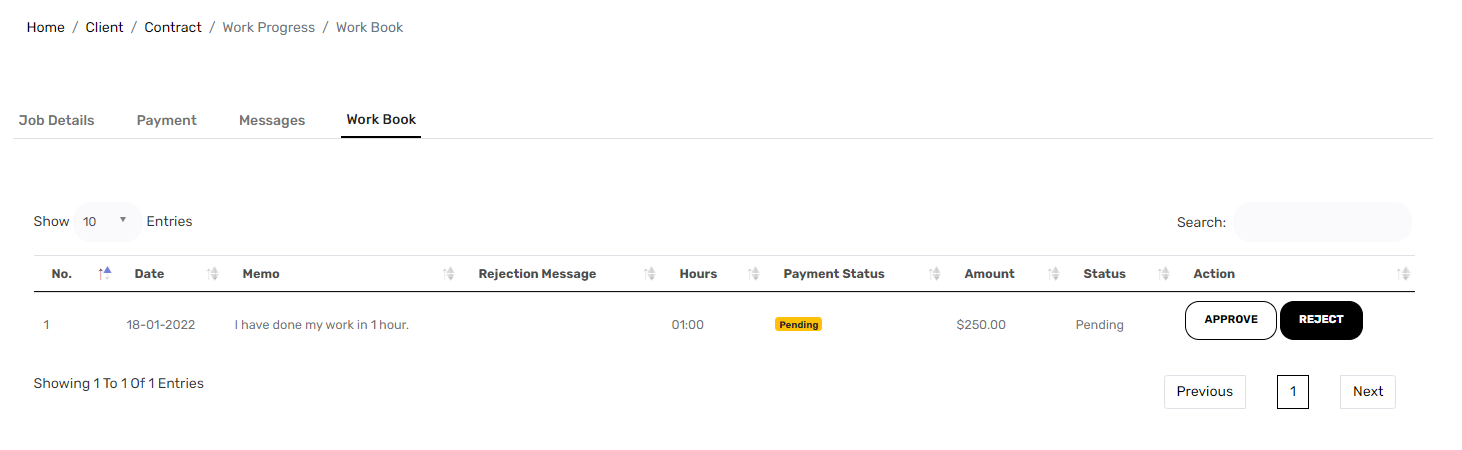

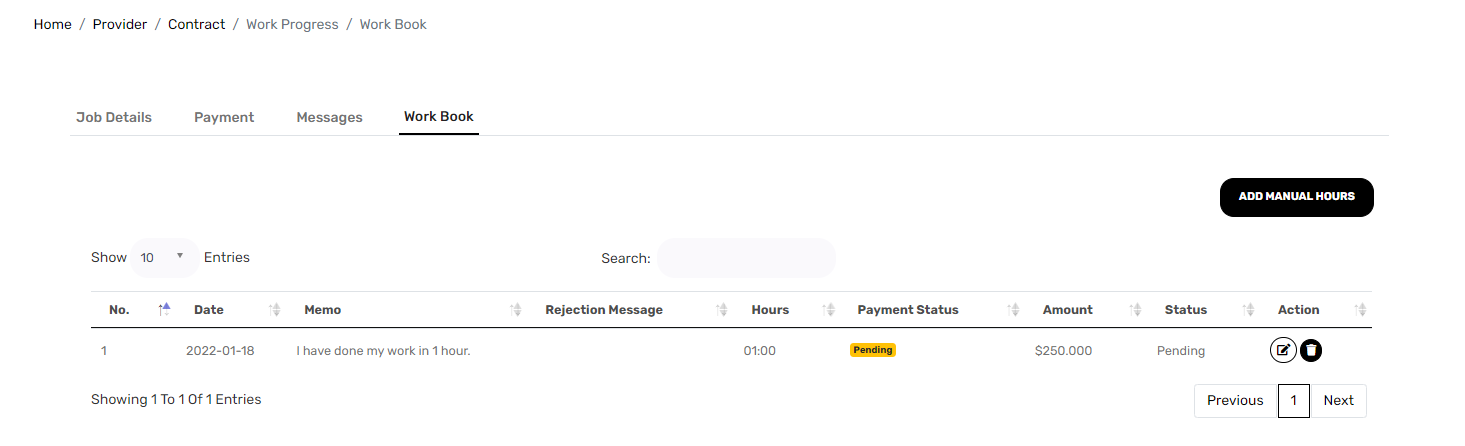

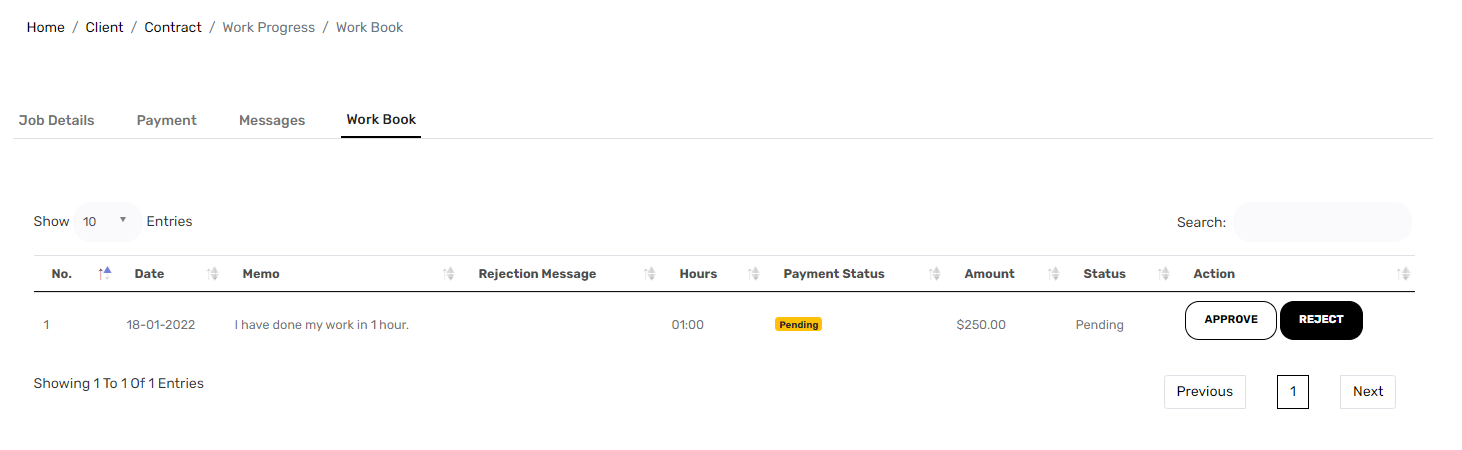

Contract is started. Provider added 1 hour in his workbook for one day and client approve those hours then

Contract is for $250.00

Amount: $250.00 * 1hours.

Provider recieve payment = 250.00 - payout charges (approx 1.25%)

When system automatically charge client at day end from default payment method choosed while making contract (Amount: $250.00) + stripe fee + platform fee + internation fee (if apply on payment method), after some 3-4 days(not next day) provider will credited Total:(250.00 - payout charges (approx 1.25%)in their connected bank when payment is available.

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled including security money (Amount: $500.00) or money will not deducted from client side.

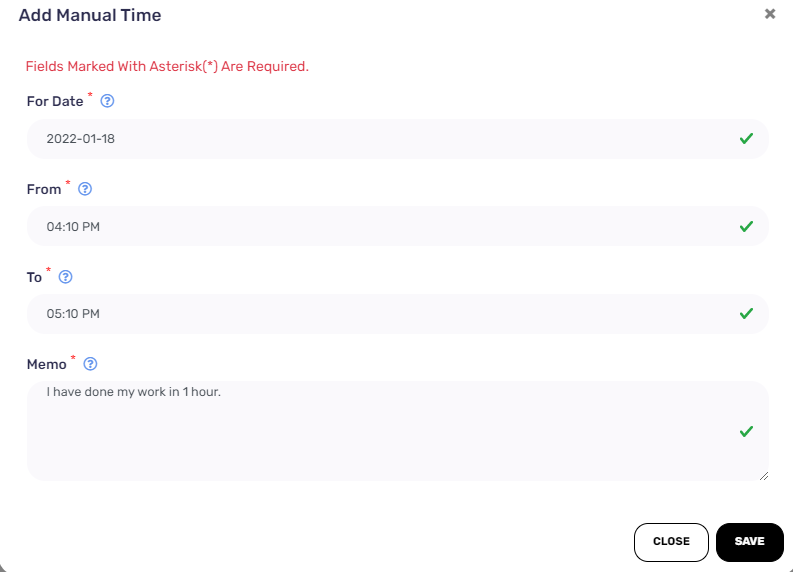

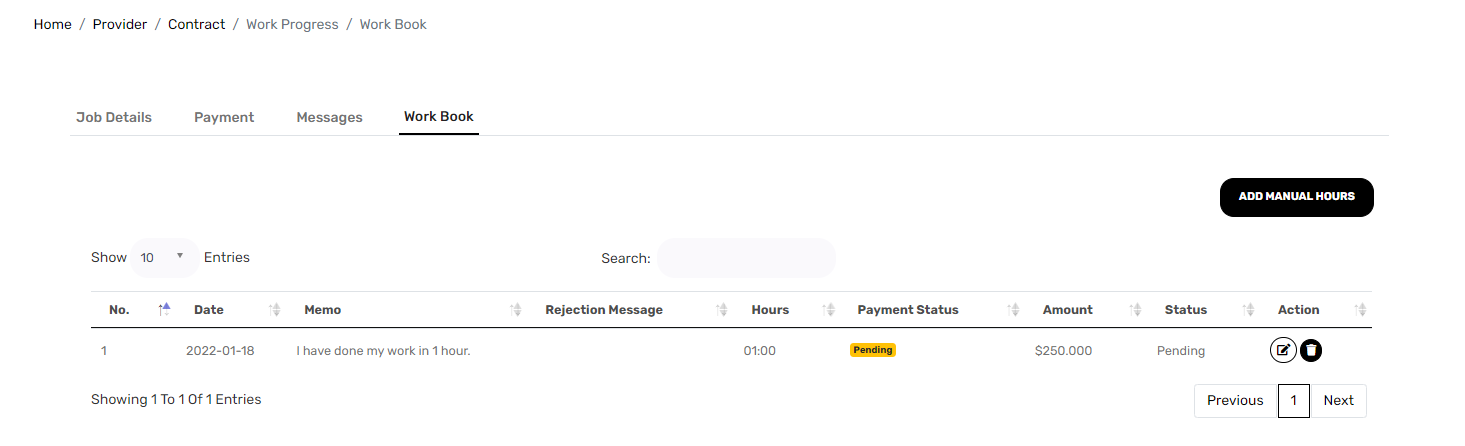

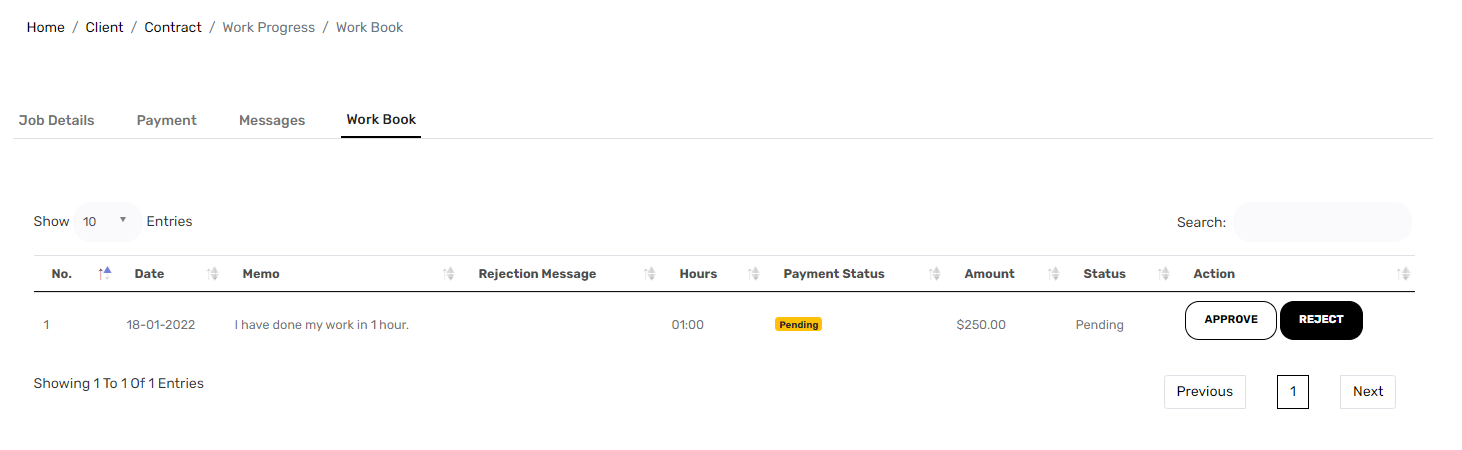

3. Hourly (Weekly)

This is recurring fixed amount of payment which happen on weekly based on hours entered by provider. When client is making contract he/she needs to put some amount basis on some estimated hours. These hours are used for security purpose which will fully refundable and not actually taking money from client, it is just locked payment on client’s card . For example initiate

Contract is for $250.00

Security Amount: $250.00 * 2 hours(estimated hour provider will work).

Stripe Fee: $15.69 (Included)

Service fee: $15.00 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Total security: $530.69(approx.) (this payment used as security as a part of escrow).

So when provider see that contract. He can either do Accept/Reject.

Contract is started. Provider added 1 hour in his workbook for one week and client approve those hours then

Contract is for $250.00

Amount: $250.00 * 1hours.

Provider recieve payment = 250.00 - payout charges (approx 1.25%)

When system automatically charge client at day end (Amount: $250.00)+ stripe fee + platform fee + internation fee (if apply on payment method), at weekend provider will credited Total: (250.00 - payout charges (approx 1.25%) in their connected bank.

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled including security money (Amount: $500.00) or money will not deducted from client side.

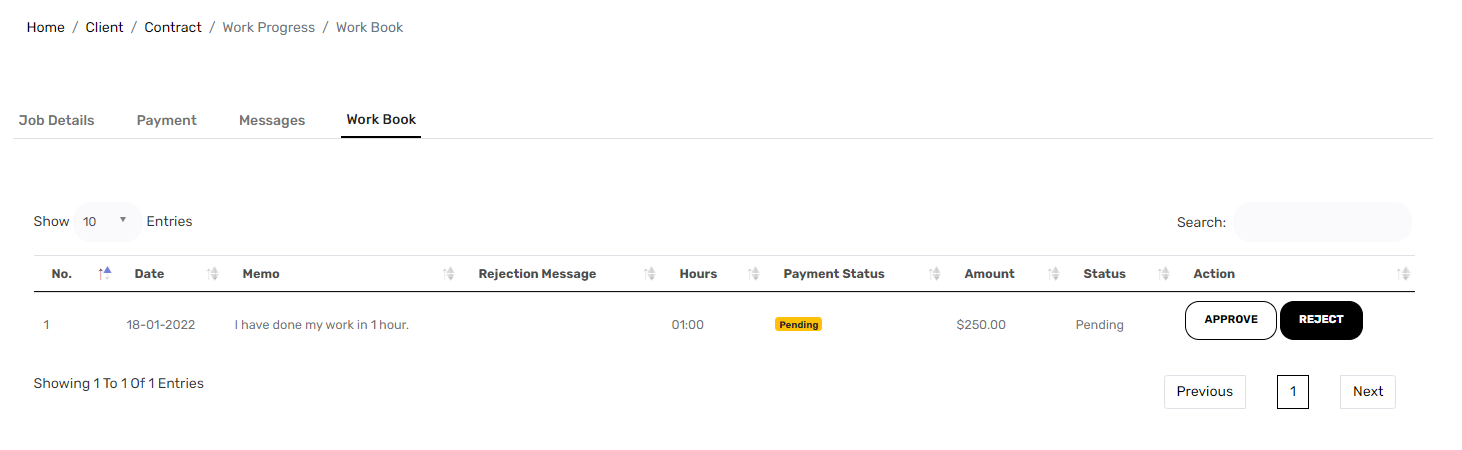

4. Hourly (Biweekly)

This is recurring fixed amount of payment which happen on biweekly(14 days) based on hours entered by provider .When client is making contract he need to put some amount basis on some estimated hours. These hours are used for security purpose will fully refundable(as part of escrow).For example initiate

Contract is for $250.00

Security Amount: $250.00 * 2 hours(estimated hour provider will work).

Stripe Fee: $15.69 (Included)

Service fee: $15.00 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Total security: $530.69(approx.) (this payment used as security as a part of escrow).

So when provider see that contract. He can either do Accept/Reject.

Contract is started. Provider added 1 hour in his workbook in biweekly and client approve those hours then

Contract is for $250.00

Amount: $250.00 * 1hours.

Provider recieve payment = 250.00 - payout charges (approx 1.25%)

When system automatically charge client at day end (Amount: $250.00) + stripe fee + platform fee + internation fee (if apply on payment method), at biweekly(after 14 days) provider will credited Total: (250.00 - payout charges (approx 1.25%) in their connected bank.

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled including security money (Amount: $500.00) or money will not deducted from client side.

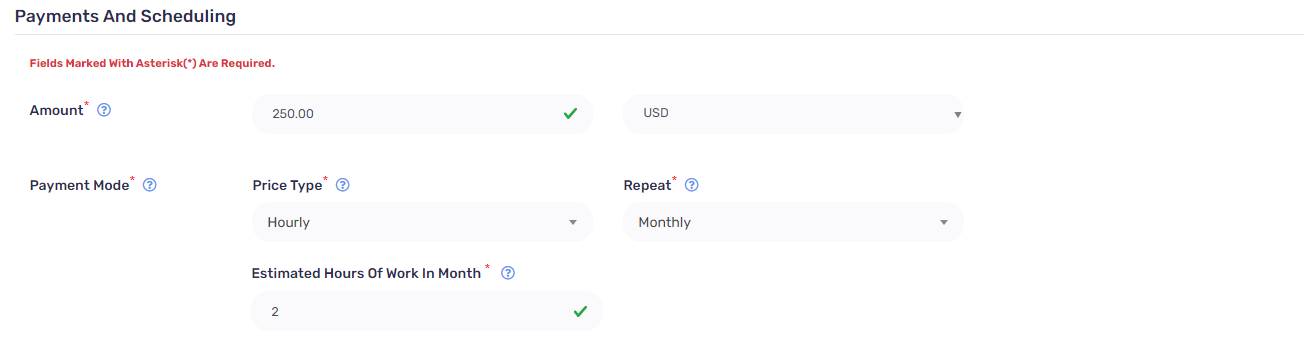

5. Hourly (Monthly)

This is recurring fixed amount of payment which happen on monthly based on hours entered by provider .When client is making contract he need to put some amount basis on some estimated hours. These hours are used for security purpose will fully refundable(as part of escrow).For example initiate

Contract is for $250.00

Security Amount: $250.00 * 2 hours(estimated hour provider will work).

Stripe Fee: $15.69 (Included)

Service fee: $15.00 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Total security: $530.69(approx.) (this payment used as security as a part of escrow).

So when provider see that contract. He can either do Accept/Reject.

Contract is started. Provider added 1 hour in his workbook in month and client approve those hours then

Contract is for $250

Amount: $250.00 * 1hours.

Service Fee: 5%

Total: $237.50 (this payment will go to provider after work done).

When system automatically charge client at day end (Amount: $250.00) + stripe fee + platform fee + internation fee (if apply on payment method), at end of month provider will credited Total: (250.00 - payout charges (approx 1.25%) in their connected bank.

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled including security money (Amount: $500.00) or money will not deducted from client side.

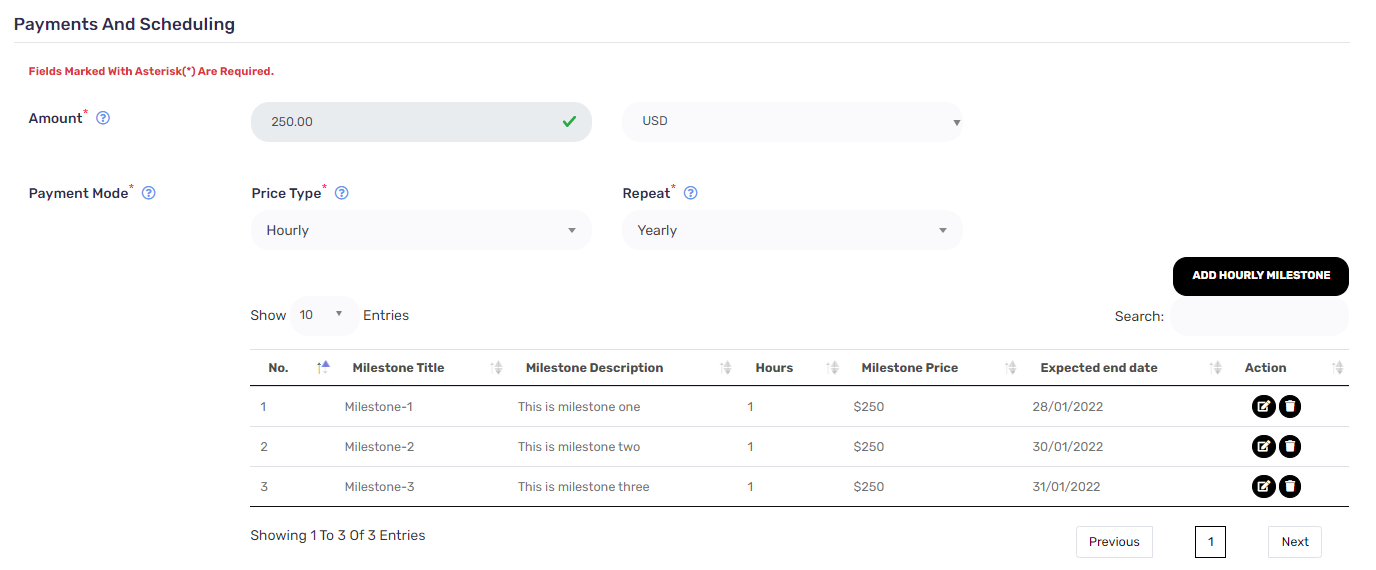

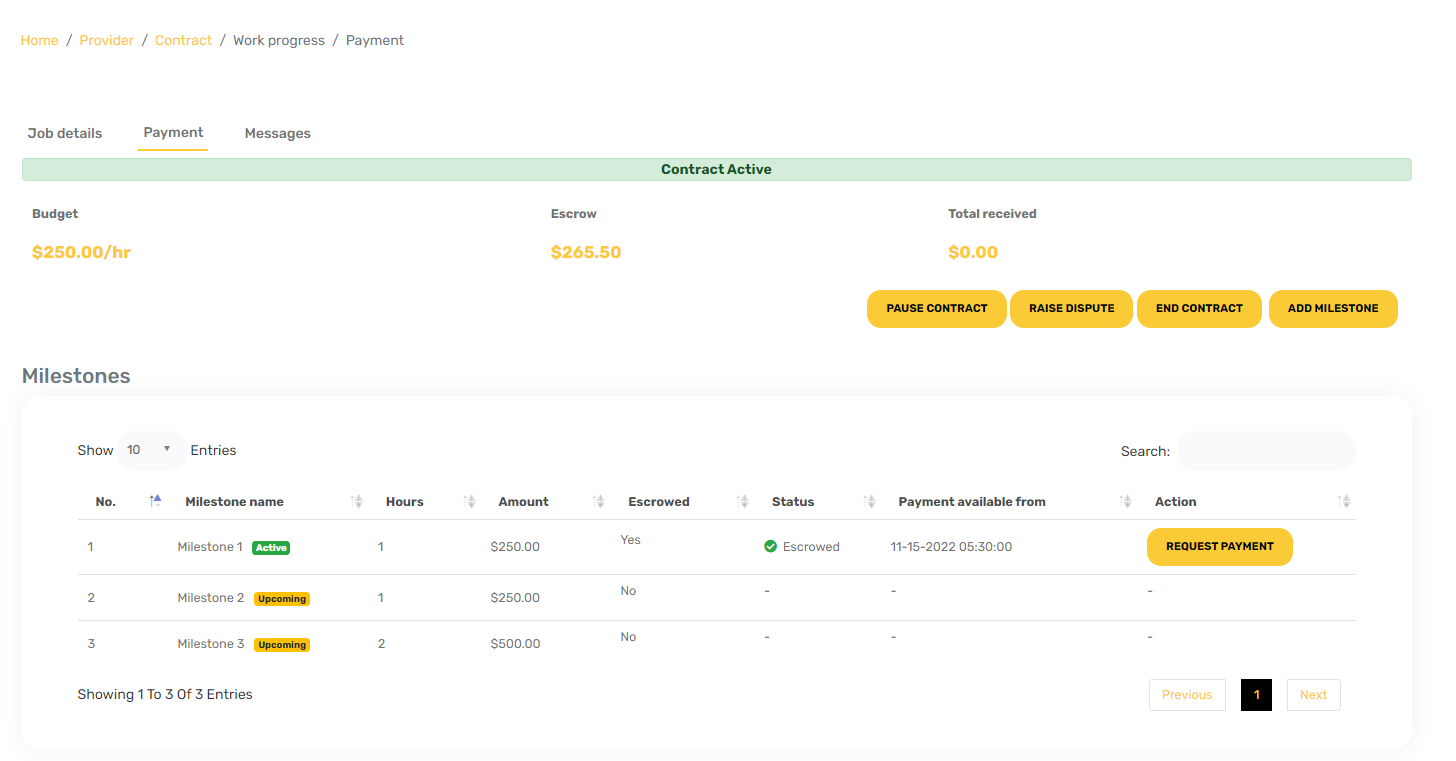

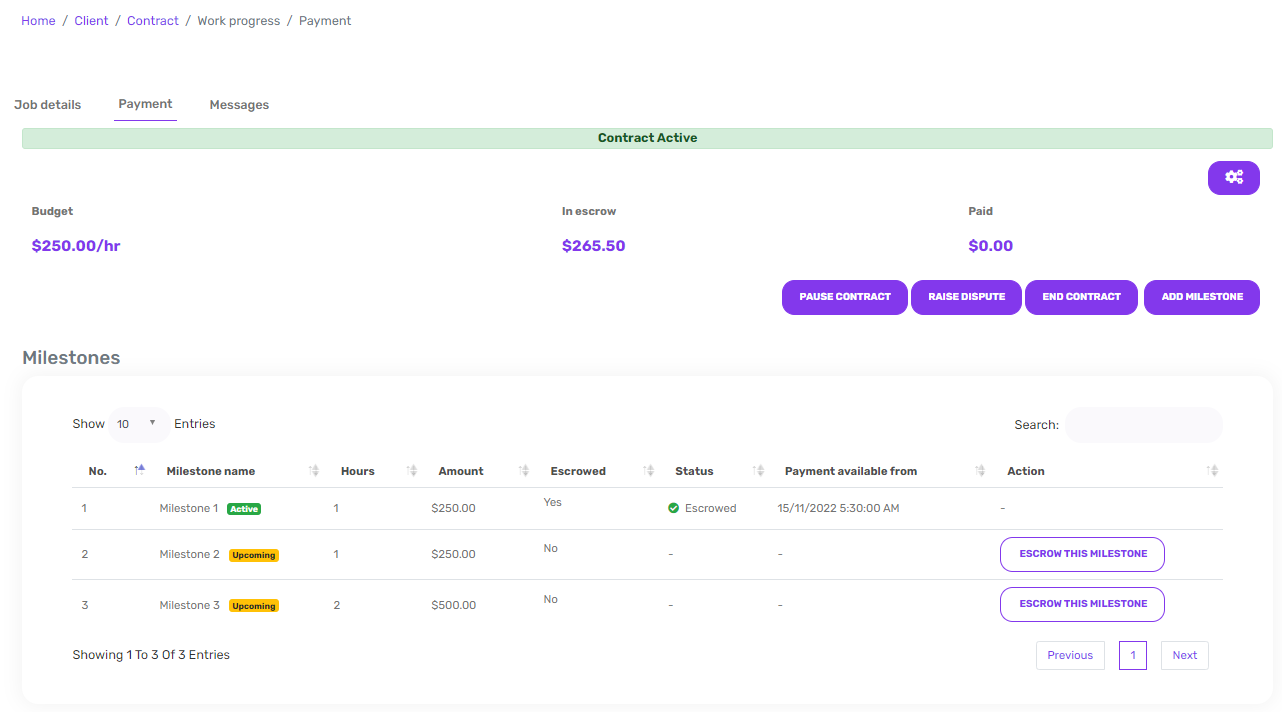

6. Hourly (Yearly)

This is manual fixed amount of payment basis on hours .When client is making contract he need to put first milestone amount in escrow. Client that contract. For example initiate

a. Milestone-1 : $250.00 (some x numbers of hours)

b. Milestone-2 : $250.00 (some x numbers of hours)

c. Milestone-3 : $250.00 (some x numbers of hours)

Milsestone-1 for $250.00

Hours : 1

You will be charged for escrow deposit: $265.50

Milsestone Amount : $250.00 * 1= $250.00

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Milestone amount($250.00) - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

Contract is started.Payment will be released after work done and requested from provider, Provider recieve payment = Milestone amount($250.00) - payout charges (approx 1.25%)

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled including security money (Amount: $250.00) or money will not deducted from client side.

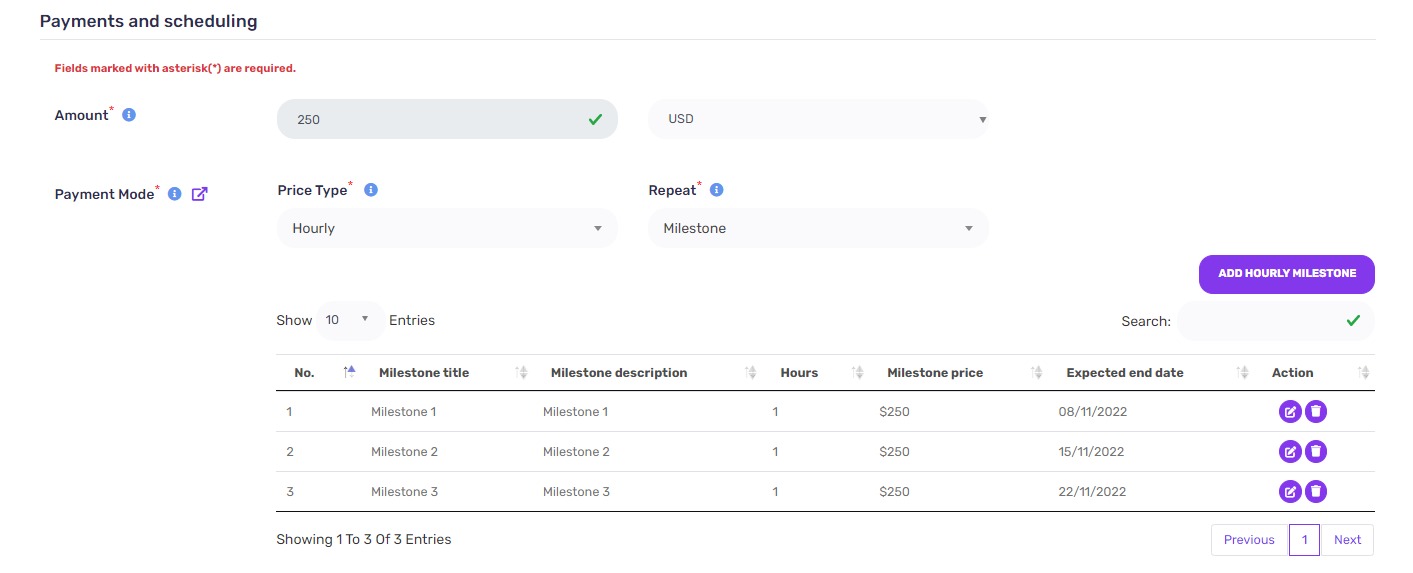

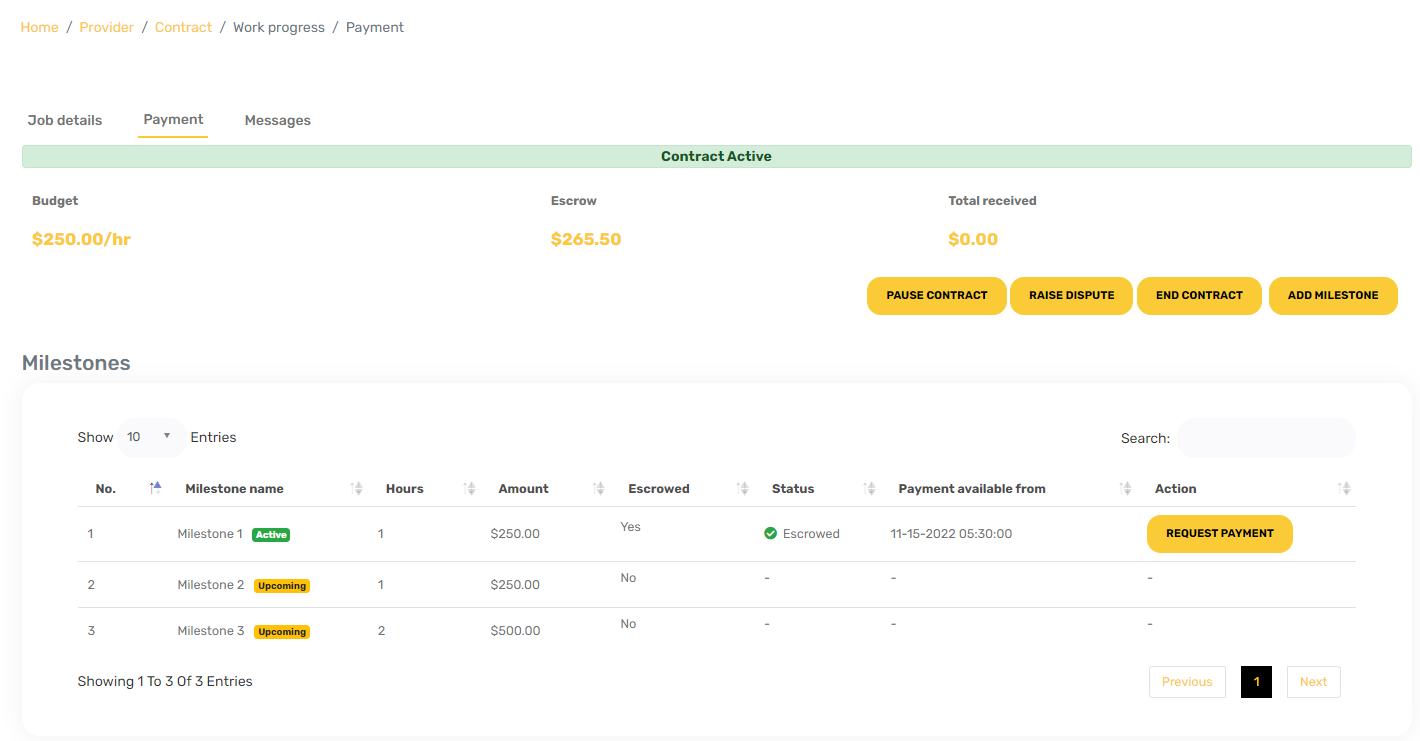

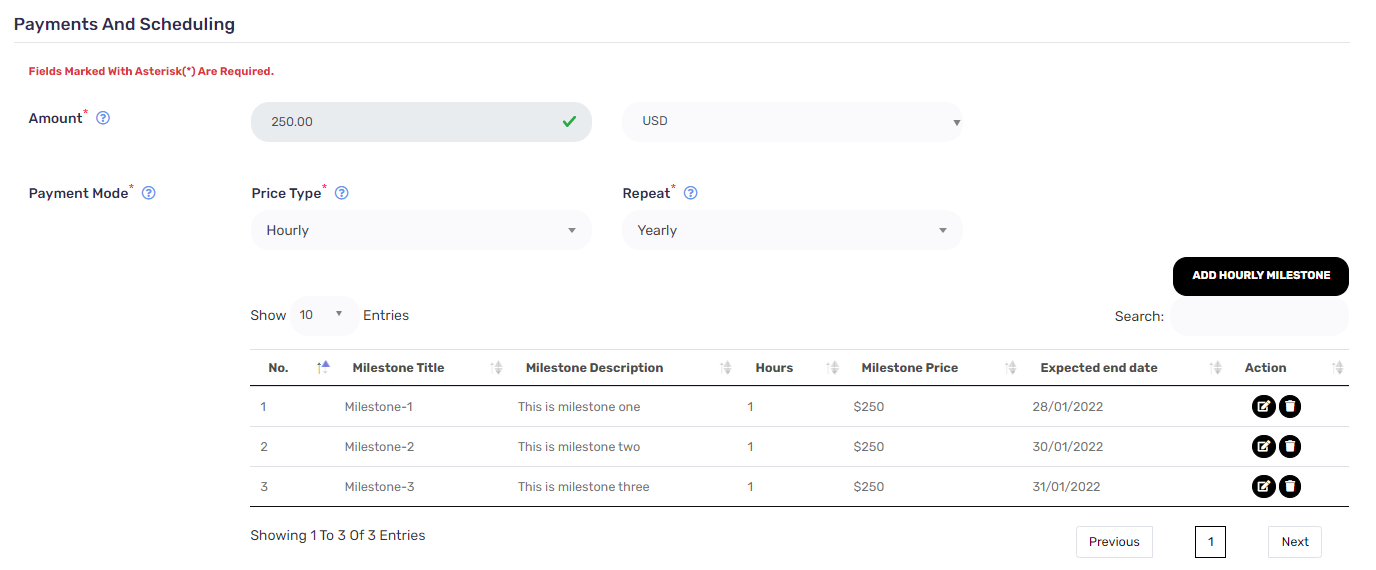

7. Hourly (Milestone)

This is manual fixed amount of payment basis on hours. When client is making contract he need to put first milestone amount in escrow. Client that contract. For example initiate

a. Milestone-1 : $250 (some x numbers of hours)

b. Milestone-2 : $250 (some x numbers of hours)

c. Milestone-3 : $250 (some x numbers of hours)

Milsestone-1 for $250.00

Hours : 1

You will be charged for escrow deposit: $265.50

Milsestone Amount : $250.00 * 1= $250.00

Stripe Fee: $8.00 (Included)

Service fee: $7.50 (Included) Depends on active client subscription service fee percentage

International card fee: 1% international fee, if card is non US (Excluded)

Provider recieve payment = Milestone amount - payout charges (approx 1.25%)

So when provider see that contract. He can either do Accept/Reject.

Contract is started.Payment will be released after work done and requested from provider, provider will credited Total: Milestone amount($250.00) - payout charges (approx 1.25%)

If Contract is rejected/cancel by providerIf contract is rejected, all payment will be canceled including security money (Amount: $250.00) or money will not deducted from client side.

Stripe Charges

- 1. Per successful payment card charges

- 2. Avoiding currency conversions

- 3. Conversions on disputes and refunds

- 4. ACH direct debit transfer charge

1. Per successfull transaction card charges

- 2.9% + $0.30

- +1% for non US cards

- +1% if currency conversion

2. Avoiding currency conversions

Currency conversions occur at the time the charge is made. If there are multiple bank accounts available for a given currency, Stripe uses the one set as default_for_currency. If there is no bank account available for that currency, Stripe automatically converts those funds to your default settlement currency. If there is a bank account available for that currency at the time the charge is made, no conversion occurs.

3. Conversions on disputes and refunds

If a currency-converted payment is disputed or refunded, the amount you received is converted back to the

presentment currency (the presentment currency is the currency the customer uses to make a payment)at the current rate. This fluctuates on a daily basis, so the rate used when a charge

is converted often differs from the rate used when a dispute or refund occurs. The returned amount can be

less—or more—than what the payment provided. Ultimately, a customer is always refunded the exact amount they

paid and in the currency they paid in, regardless of the rate and cost to the Stripe user.

For example, if your settlement currency is EUR and you process a 60 USD payment at a rate of 0.88 EUR per

1 USD, the converted amount is 52.80 EUR (excluding the Stripe fee). If the rate is 0.86 EUR per 1 USD at the time of refund,

the amount deducted from your account balance is only 51.60 EUR.

4. ACH direct debit transfer charge

ACH payments on Stripe cost 0.80%, capped at $5.00, with no monthly fees or verification fees. So, a $100.00 payment incurs a $0.80 fee; any payments above $625.00 cost $5.00

Refund

- 1. When client cancels a milestone payment

- 2. Refund of disputed contract payments

- 3. When contract ends, client will get refund of not started milestones payments

1. When client cancels a milestone payment

On cancelling a milestone payment, client will get refund of total amount paid respective to that milestone without stripe fee, for example (suppose a milestone amount is $100, stripe fee is $3.00 and platform fee is $1 total paid = $104.00, when client cancel that milestone payment, client will get $101.00 as refund). (Total refund = total paid - stripe fee) (Note: Client can't' cancel started miletsone payments)

2. Refund of disputed contract

When dispute is in the favour of client then client will get refund without stripe fee. for example (suppose a milestone amount is $10, stripe fee is $0.30 and platform fee is $1.00 total paid = $11.30, when client cancel that milestone payment, client will get refund of $11.00) (Total refund = total paid - stripe fee)

3. When contract ends, client will get refund of not started milestones payments.

When a contract is ended then client will get refund of all not started milestone payments. for example (suppose a milestone amount is $10.00, stripe fee is $0.30 and platform fee is $0.10 total paid = $10.40, when client cancel that milestone payment, will get refund of $10.10) (Total refund = total paid - stripe fee)

Contract pause and resume

Client and provider both can pause and resume the contract from contract view progress, if client will pause the contract only client can resume that contract or vice versa. Contract is also paused by application, if any payment failed and at that time no payment is in escrow. When client made a successful payment then client or provider can resume that contract.

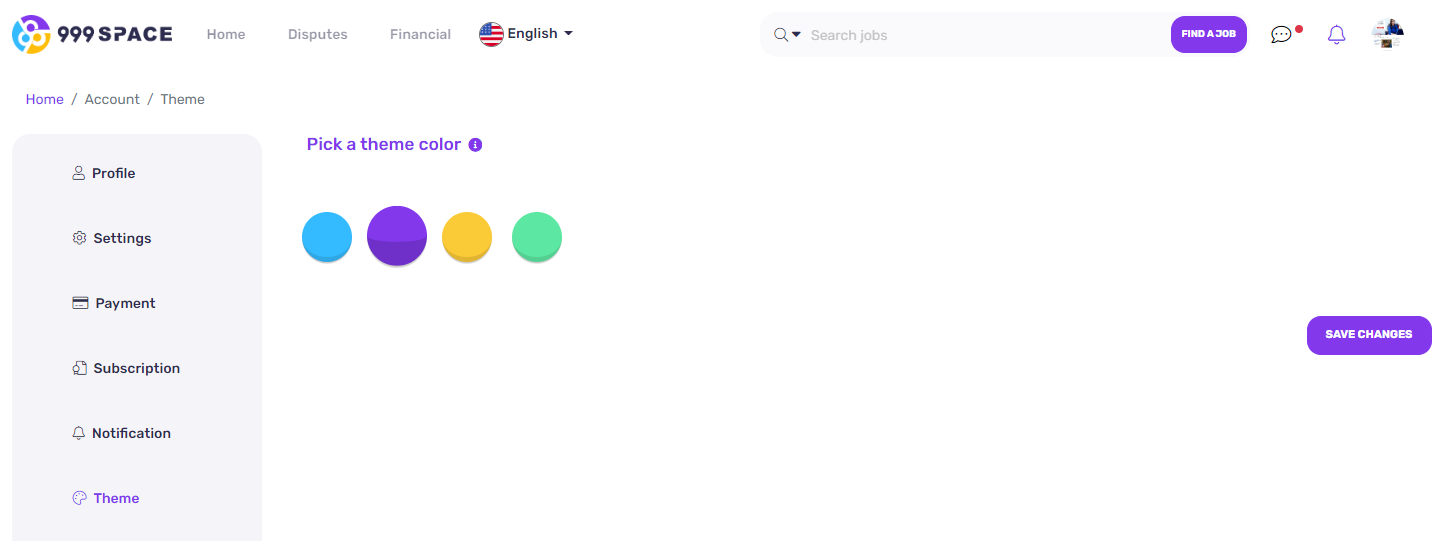

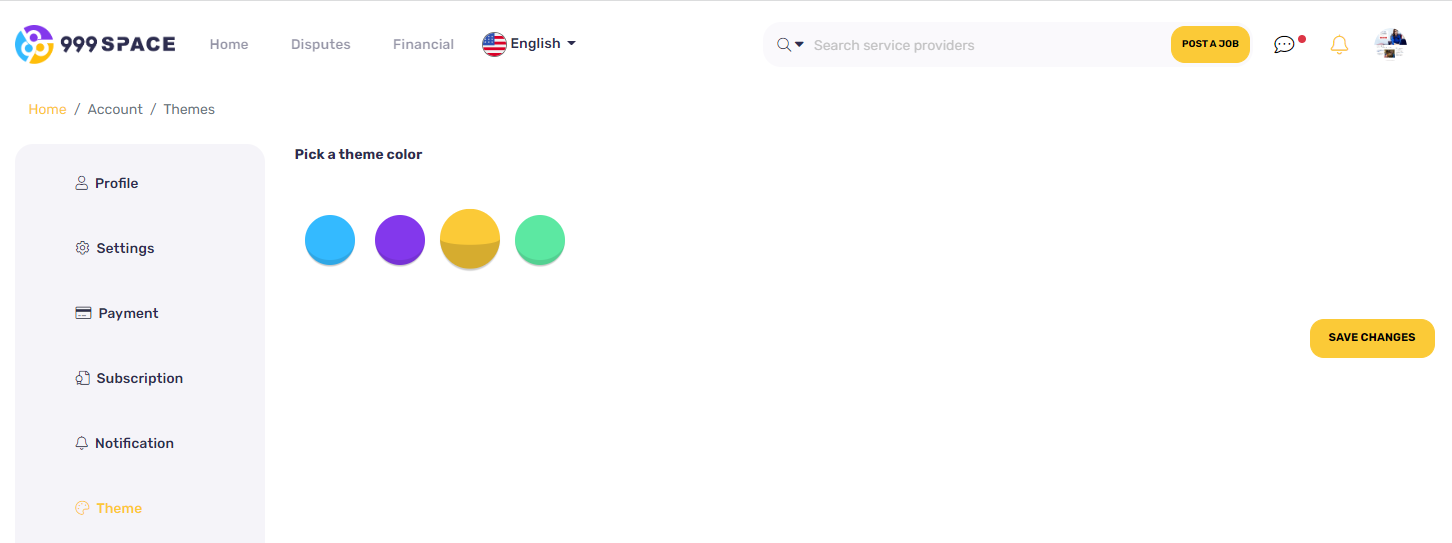

Theme color

From theme section a user can select different-different theme color for their provider and client profile. The theme color user selected will reflect in different areas like view job, placing bid, View Bid, accept bid, reject bid, hire provider, invite provider, view contract details, edit job, profiles, settings, payments, subscription, notification, pagination etc..

- 1. Selected tab color

- 2. Button color

- 3. Icon color

-

Suppose user selected 2nd color

Suppose user selected 3rd color

Suppose user selected 3rd color

Minimum Age Requirement

Your age must be at least 13 years old in order to user our services.